Back to Resources

Back to Resources

On December 22, just a few weeks following the passage of the Senate’s Tax Cuts and Jobs Act, the conference version of the bill was signed into law, marking it the largest change to U.S. tax policy in decades.

What Changes are Coming for Technology Organizations?

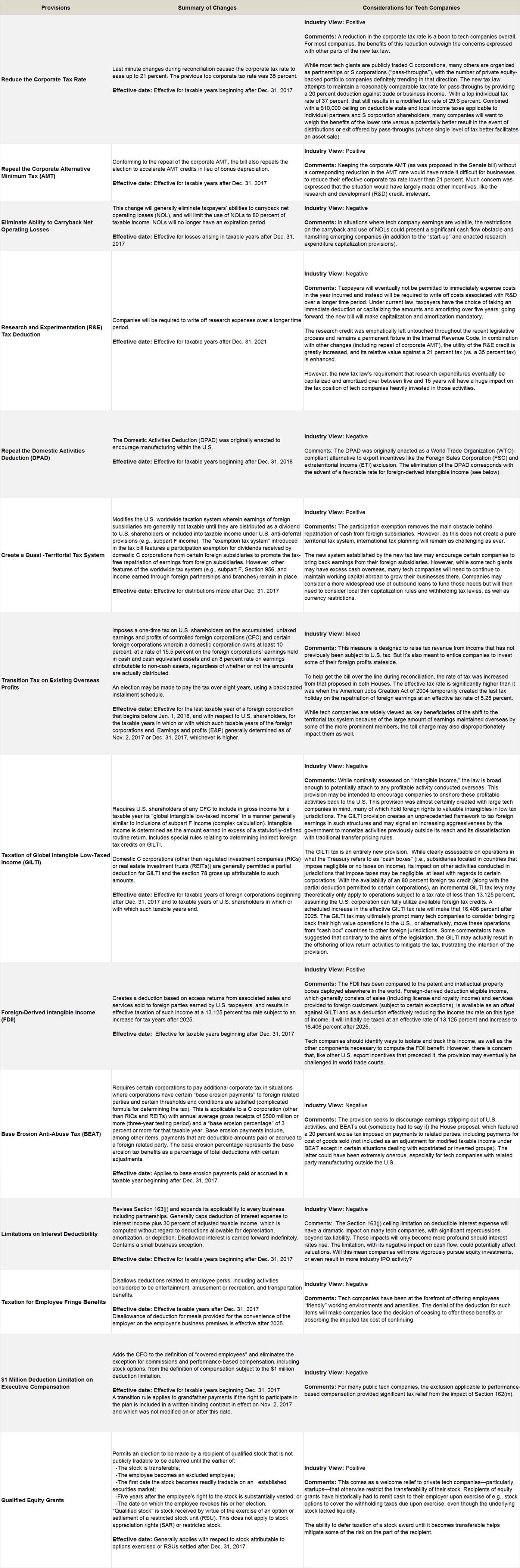

To help organizations navigate the issues most impactful and urgent to the technology industry, we’ve provided a detailed anaylsis of the key provisions and their industry implications based on the signed legislation.

What Should You Do Now?

Here are five steps technology companies should take now to tackle tax reform:

1. Assess impact. Tax professionals will likely need to review the bill text manually and measure their organization’s specific circumstances against it to assess the impact of each provision and their holistic effect on their bottom line.

2. Assemble a team. While the heaviest burden may fall on accountants, companies and their finance teams will have an important role to play in gathering all the necessary data.

3. Dig into the data. Assessing the impact of tax reform requires a substantial amount of data. Organizations need to move from modeling the impact of tax reform to focus on data collection and computations as soon as possible. If you have an international presence, bear in mind that some of the information needed could date back to 1987.

4. Establish priorities. When considering what next steps to take, focus on the areas that could have the greatest impact on your organization.

5. Initiate tax reform conversations with your tax advisor. Tax reform of this magnitude is the biggest change we’ve seen in a generation, and will require intense focus to understand not only how the changes apply at the federal level, but also to navigate the ripple effect this is likely to have on state taxation as well.

Key Provisions for the Tech Industry

Please look for future communications from Smith and Howard’s tax practice on additional details of the new tax bill. Keep in mind that it is important to speak with your tax professional before taking any action. If you have any questions about how the new tax bill can affect your technology company, contact Debbie Torrance at 404-874-6244 or fill out the form below.

How can we help?

If you have any questions and would like to connect with a team member please call 404-874-6244 or contact an advisor below.

CONTACT AN ADVISOR