Back to Resources

Back to Resources

The Tax Cuts and Jobs Act (TCJA) brings many changes to nonprofits. For example, the TCJA changes the overall method used to report multiple activity streams of unrelated business income. The impact affects each entity differently making it very important to speak with your tax professional before taking any action.

The TCJA disallows the netting of business losses from one economic activity with the income of another activity. Prior to the implementation of TCJA, taxpayers were allowed to aggregate the profit and losses from all unrelated activities and pay income tax on the net amount. For example, under old law, if an organization had two separate unrelated business activities and one showed a loss of $200 in the same year the second activity showed net income of $800, the organization would report taxable income of $600 and compute tax on the net amount.

Some common sources of UBIT are listed below:

- Advertising

- Rent income (debt financing)

- Rental of personal property

- Restaurants

- Special events

- Debt financed investment income

- Hedge funds

- Gift shop (unrelated items)

- Parking Lot

- Non-member use of country clubs

- Joint ventures with for-profits

- Income from subsidiaries

The determination of an activity as UBIT is very fact-specific so we recommend you consult your tax professional to help your organization ensure all sources of UBIT are properly reported on your organization’s tax return.

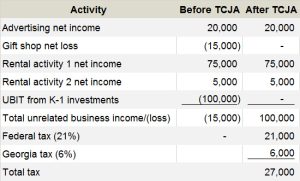

In the hypothetical example on the right, the nonprofit engages in various unrelated business activities. The next column (moving left to right), illustrates how unrelated business activities are currently taxed. The final column shows how unrelated business activities will be taxed under the TCJA. Prior to TCJA, the organization incurred a net loss on all activities and did not owe any tax. After TCJA, only activities with net income are considered in the UBIT calculation; therefore, under the same fact pattern, the organization will owe tax under TCJA.

Note that the example does not consider a net operating loss carryforward and does not accrue for state income tax on UBIT.

As with any change in tax law, there are opportunities for planning. One positive change for business taxpayers is that the corporate tax rate has been reduced from 35% to 21%, which means nonprofits will pay a lower tax rate on UBI activities than required prior to 2018.

It is important to speak with your tax professional before taking any action.

The changes in this article are permanent changes under the TCJA and are effective for tax years beginning after December 31, 2017. Net operating losses incurred on UBIT activities prior to 2018 are preserved and available to reduce taxable income on UBIT activities in future years.

Please look for future communications from Smith and Howard’s tax group on additional details of the new tax bill. Keep in mind that it is important to speak with your tax professional before taking any action. For questions on how your nonprofit should address the recent tax provisions, please contact Marc Azar or Sabre Linahan at 404-874-6244.

How can we help?

If you have any questions and would like to connect with a team member please call 404-874-6244 or contact an advisor below.

CONTACT AN ADVISOR