Back to Resources

Back to Resources

In continuation of our series on the impact of Accounting Standards Update 2016-14, Presentation of Financial Statements of Not-for-Profit Entities (“ASU”), issued by the Financial Accounting Standards Board (“FASB”) in August 2016, this article focuses on the topic of liquidity and available resources. The ASU requires qualitative and quantitative information on the available cash flow for a nonprofit. These disclosures include the following:

Qualitative disclosures: information in the notes to the financial statements that is useful in assessing a nonprofit’s liquidity and that communicates how a nonprofit manages its liquid resources available to meet cash needs for general expenditures within one year of the date of the statement of financial position.

Quantitative disclosures: information either on the face of the statement of financial position or in the notes, and additional qualitative information in the notes as necessary, that communicates the availability of a nonprofit’s financial assets at the date of the statement of financial position to meet cash needs for general expenditures within one year of the date of the statement of financial position. Availability of a financial asset may be affected by:

a) its nature

b) external limits imposed by donors, laws, and contracts with others

c) internal limits imposed by governing board decisions

The liquidity and available resources disclosure requirements have raised the most questions from nonprofits as it requires a new calculation and detail disclosure. The complexity of the calculation depends on the statement of financial position and the factors affecting availability. Based on the guidance provided in the ASU, below are three example disclosures. Each one demonstrates a different way to present the required information. One method provides the qualitative and quantitative disclosure in a narrative form. The other methods combine tables and narratives as provided in examples two and three.

Example 1 – Quantitative and Qualitative in Narrative Form

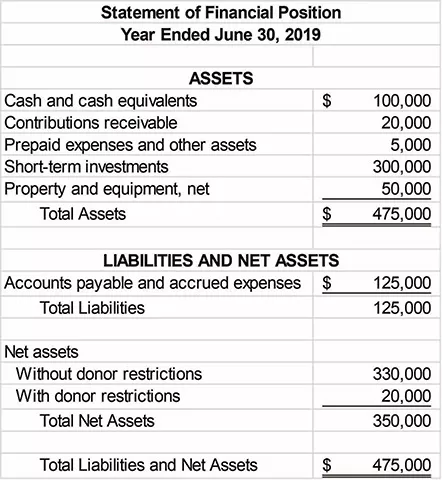

The statement of financial position presented below is an example of a nonprofit that has limited donor restricted funds and a basic liquidity and available resources calculation.

Note X – Liquidity and Availability of Resources

Nonprofit ABC, Inc. has $420,000 of financial assets available within one year of the statement of financial position date to meet cash needs for general expenditures consisting of substantially cash of $100,000, contributions receivable of $20,000, and short-investments of $300,000. None of the financial assets are subject to donor or other contractual restrictions that make them unavailable for general expenditures within one year of the statement of financial position. The contributions receivable are subject to implied time restrictions but are expected to be collected within one year. Nonprofit ABC, Inc. has a goal to maintain financial assets, which consist of cash and short-term investments, on hand to meet 60 days of normal operating expense, which are, on average, approximately $300,000. Nonprofit ABC, Inc. has a policy to structure its financial assets to be available as its general expenditures, liabilities and other obligations come due. In addition, as part of its liquidity management, Nonprofit ABC, Inc. invests cash in excess of daily requirements in various short-term investments, including certificates of deposit and short-term treasury instruments. As described in Note 5, Nonprofit ABC, Inc. also has a line of credit in the amount of $50,000, which it could draw upon in the event of an unanticipated liquidity need.

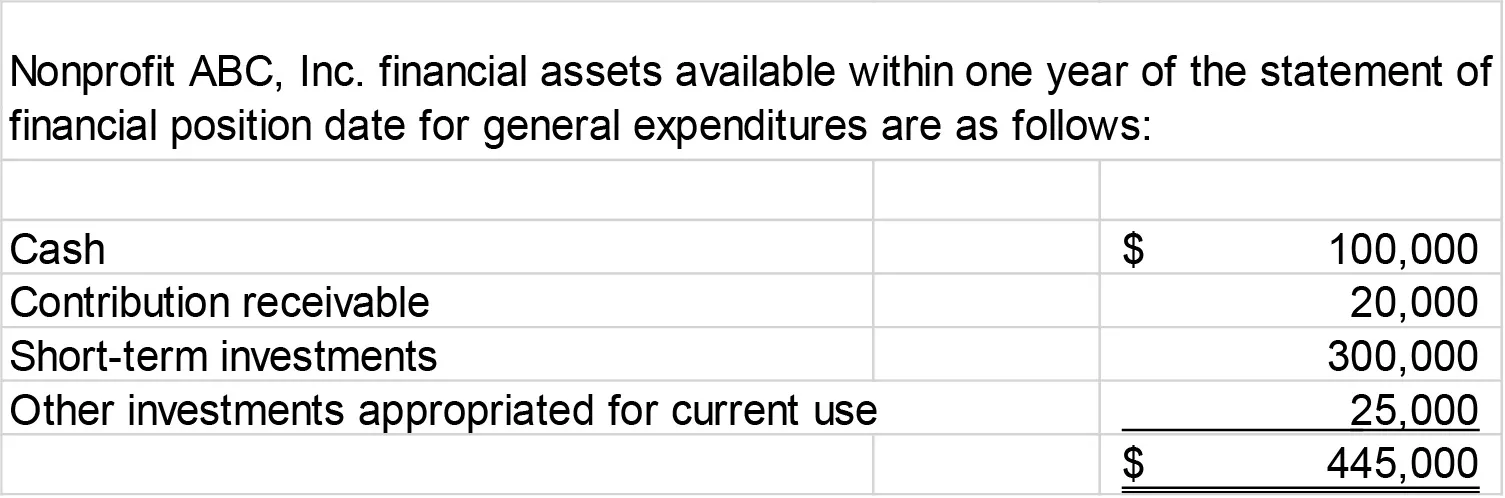

Example 2 – Quantitative and Qualitative with Table and Narrative

Similar to example 1, this example provides the financial assets available within one year of the statement of financial position for general expenditures; however, in this example, our nonprofit has donor restricted endowments and a quasi–endowment.

Note X – Liquidity and Availability of Resources

Nonprofit ABC, Inc.’s endowment funds consist of donor-restricted endowments and a quasi-endowment. Income from donor-restricted endowments is restricted for specific purposes and, therefore, is not available for general expenditures. As described in Note 3, the quasi-endowment has a spending rate of 5 percent. $25,000 of appropriations from the quasi-endowment will be available within the next 12 months. As part of Nonprofit ABC, Inc.’s liquidity management, it has a policy to structure its financial assets to be available as its general expenditures, liabilities, and other obligations come due. In addition, Nonprofit ABC, Inc. invests cash in excess of daily requirements in short-term investments. To help manage unanticipated liquidity needs, Nonprofit ABC, Inc. has a committed line of credit in the amount of $50,000, which it could draw upon. Additionally, Nonprofit ABC, Inc. has a quasi-endowment of $500,000. Although Nonprofit ABC, Inc. does not intend to spend from its quasi-endowment other than amounts appropriated for general expenditures as part of its annual budget approval and appropriation process, amounts from its quasi-endowment could be made available if necessary. However, both the quasi-endowment and donor-restricted endowment contain investments with lock-up provisions that would reduce the total investments that could be made available.

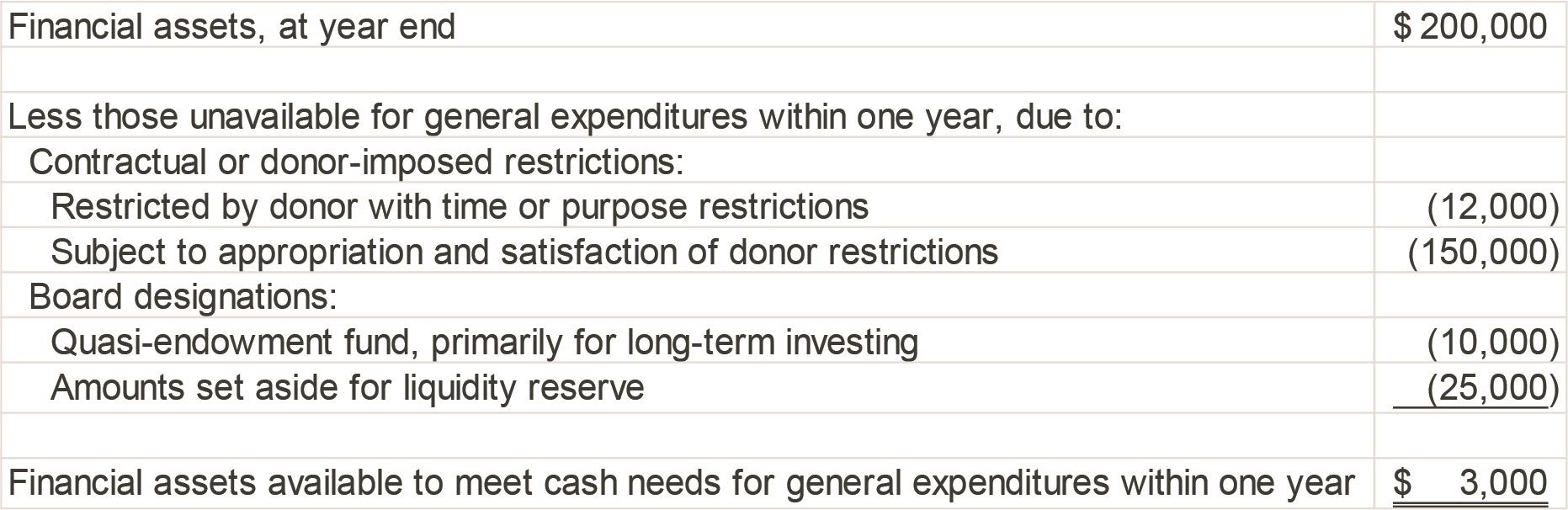

Example 3 – Quantitative and Qualitative with Table and Narrative

The example below is another format to present the quantitative disclosures. It begins with the financial assets at year end, excluding property, plant, and equipment and prepaid assets, then deducts the assets that are not available within one year of the statement of financial position for general expenditures.

Note X – Liquidity and Availability of Resources

Nonprofit ABC, Inc. is substantially supported by restricted contributions. Because a donor’s restriction requires resources to be used in a particular manner or in a future period, Nonprofit ABC, Inc. must maintain sufficient resources to meet those responsibilities to its donors. Thus certain financial assets may not be available for general expenditures within one year. As part of Nonprofit ABC, Inc.’s liquidity management, it has a policy to structure its financial assets to be available as its general expenditures, liabilities, and other obligations come due. In addition, Nonprofit ABC, Inc. invests cash in excess of daily requirements in short-term investments. Occasionally, the board designates a portion of any operating surplus to its liquidity reserves, which was $1,500 as of June 30, 2019. There is a fund established by the governing board that may be drawn upon in the event of financial distress or an immediate liquidity need resulting from events outside the typical life cycle of converting financial assets to cash or settling financial liabilities. In the event of an unanticipated liquidity need, Nonprofit ABC, Inc. also could draw upon its $50,000 available line of credit as further discussed in Note 5 or its quasi-endowment fund.

The above are just three examples of the liquidity and available resources disclosure under the new ASU; however, the intent is for the nonprofit to tell their financial story, tailoring the disclosure as appropriate.

Effective dates – fiscal years beginning after December 15, 2017, interim periods within fiscal years beginning after December 15, 2018.

Implementation – Early application is permitted and is to be applied on a retrospective basis. For comparative financials, the nonprofit can omit the liquidity and available resources disclosures for the previous year.

Look for more information from Smith and Howard in the coming months. If you have any questions about the update, please contact Sean Taylor or Kimberly Bland at Smith and Howard at 404-874-6244.

How can we help?

If you have any questions and would like to connect with a team member please call 404-874-6244 or contact an advisor below.

CONTACT AN ADVISOR