Back to Resources

Back to Resources

2022 brought significant changes to the way the business interest expense limitation under 163(j) is calculated. Improper accounting for and calculation of this expense could lead to disallowed interest deductions for taxpayers, particularly real estate enterprises who rely heavily on these deductions. In this brief article, we recap the rules and eligibility, illustrate the real property trade/business election and discuss how the 2022 changes may impact real estate enterprises.

Recap of 163(j) business interest expense limitation rules:

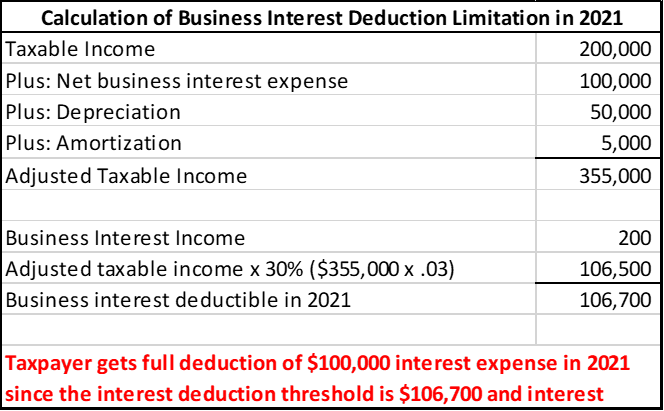

In 2017, The Tax Cuts and Jobs Act amended IRC Section 163(j) to disallow a deduction for business interest to the extent that net business interest expense exceeds 30% of Adjusted Taxable Income (ATI). ATI is a similar concept as EBITDA, or earnings before interest, taxes, depreciation, and amortization. Any amount of interest not allowed as a deduction will be treated as business interest paid in the succeeding taxable year. The chart below illustrates the basic mechanics of this calculation:

Who is subject to this limitation?

- Taxpayers with average gross receipts over $25 million (indexed for inflation) over the preceding three taxable years or

- Taxpayers who are considered “tax shelters” under IRC Section 448(d)(3), which are very generally described as partnerships with passive investors that incur losses (>35% passive investment)*

*Most real estate enterprises with losses due to depreciation are considered tax shelters by the IRS and are subject to 163(j) rules unless they make the Real Property Trade or Business Election (discussed later), even if they fall under the $25 million revenue threshold.

Exemption for certain businesses

IRC 163(j) does not apply to taxpayers whose average gross receipts for the preceding three years do not exceed $25 million, except for taxpayers considered “tax shelters.” Additionally, the following trades or businesses are exempt from 163(j) listed in IRC 163(j)(7), regardless of whether the gross receipts threshold is reached:

- The trade or business of performing services as an employee

- An electing real property trade or business (“RPTB”)*

- An electing farm business, or

- Certain regulated utility trades or business

*For purposes of this article, we are focusing on the real property trade or business election exemption.

Real Property Trade or Business Election

An eligible trade or business may make the Real Property Trade or Business (RPTB) election under IRC Section 163(j)(7)(B) in order to “opt-out” of the business interest limitation rules under IRC §163(j). IRC Section 469(c)(7)(C) defines eligible businesses as any real property development, redevelopment, construction, reconstruction, acquisition, conversion, rental, operation, management, leasing or brokerage trade or business. Certain real estate activities may not rise to the level of a trade or business (i.e., net lease w/ 3rd party property management, etc.). There are grouping election rules that may turn an otherwise unqualified activity into a qualified activity, please consult your tax advisor.

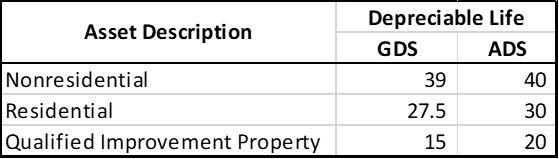

As a trade-off, any taxpayer making the RPTB election must now depreciate nonresidential, residential, and qualified improvement property using Alternative Depreciation System (ADS) as opposed to General Depreciation System (GDS). Typically, the ADS requires a longer life than the GDS method As a result ADS generates a smaller depreciation deduction, particularly in the early years of the assets’ life. Additionally, by making this election, taxpayers are foregoing the opportunity to use accelerated depreciation, or “bonus” depreciation on qualified improvement property. ADS requires depreciating assets using a straight line method over the periods below:

Note, bonus depreciation may still be claimed on certain assets that are not affected by the ADS method, such as assets with 5- and 7-year recovery periods and certain land improvements. Hence, a cost segregation study may be beneficial to identify these assets in tandem with the RPTB election to achieve a higher depreciation deduction.

This election is irrevocable, and a taxpayer cannot opt back into the interest limitation in later years when the interest is no longer limited.

Big changes are coming in 2022

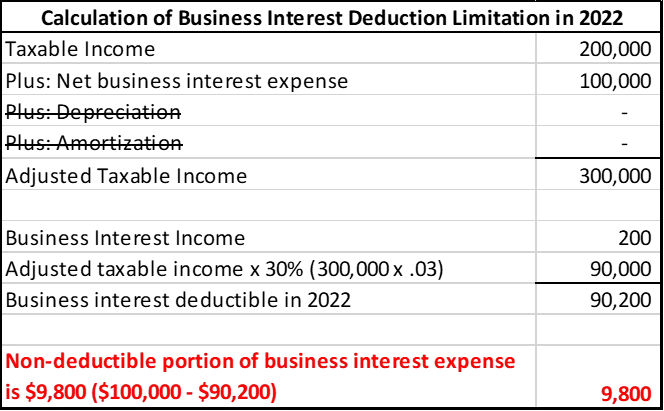

Prior to 2022, taxpayers subject to the 163(j) limitations were able to addback depreciation and amortization in the calculation of ATI, thereby allowing for a higher interest deduction. For tax years starting January 1, 2022, depreciation and amortization will no longer be allowed as an addback and could result in higher limitations for taxpayers subject to 163(j). Sticking with the same example used earlier above, the chart below illustrates the impact of removing the depreciation and amortization addbacks on the 2022 interest deduction:

All other things equal, elimination of depreciation and amortization addbacks reduces the maximum deductible interest expense by $16,500 ($55,000 x 30%). In this example (because interest expense was lower than the maximum in the original example), the deductible interest expense has decreased by $9,800 (from $100,000 to $90,200).

Putting it all together for real estate enterprises

Real estate enterprises that have not made the RPTB election up to this point have likely not run into business interest limitation issues due to the former calculation of ATI. However, with the new interpretation of ATI, those that have been properly identified as tax shelters will be faced with a decision when they file their 2022 tax returns

- Make RPTB election and “opt out” of the business interest limitation rules and use ADS depreciation going forward (receive FULL business interest expense deduction but potentially risk losing out on bigger depreciation deductions)

- Remain subject to 163(j) and use GDS depreciation (risk losing business interest expense deductibility but will likely experience greater depreciation deductions in the earlier years)

We caution readers to seek advice from a knowledgeable tax advisor prior to taking any action on the RPTB election in 2022. Smith and Howard’s real estate team welcomes the opportunity to consult with you on the pros and cons of the RPTB election and its potential implications for your business. You can access a very brief contact request by clicking the Contact an Advisor button and we’ll respond quickly.

How can we help?

If you have any questions and would like to connect with a team member please call 404-874-6244 or contact an advisor below.

CONTACT AN ADVISOR