Back to Resources

Back to Resources

On December 22, 2017, the conference version of the tax reform bill was signed into law, marking the largest change to U.S. tax policy in decades.

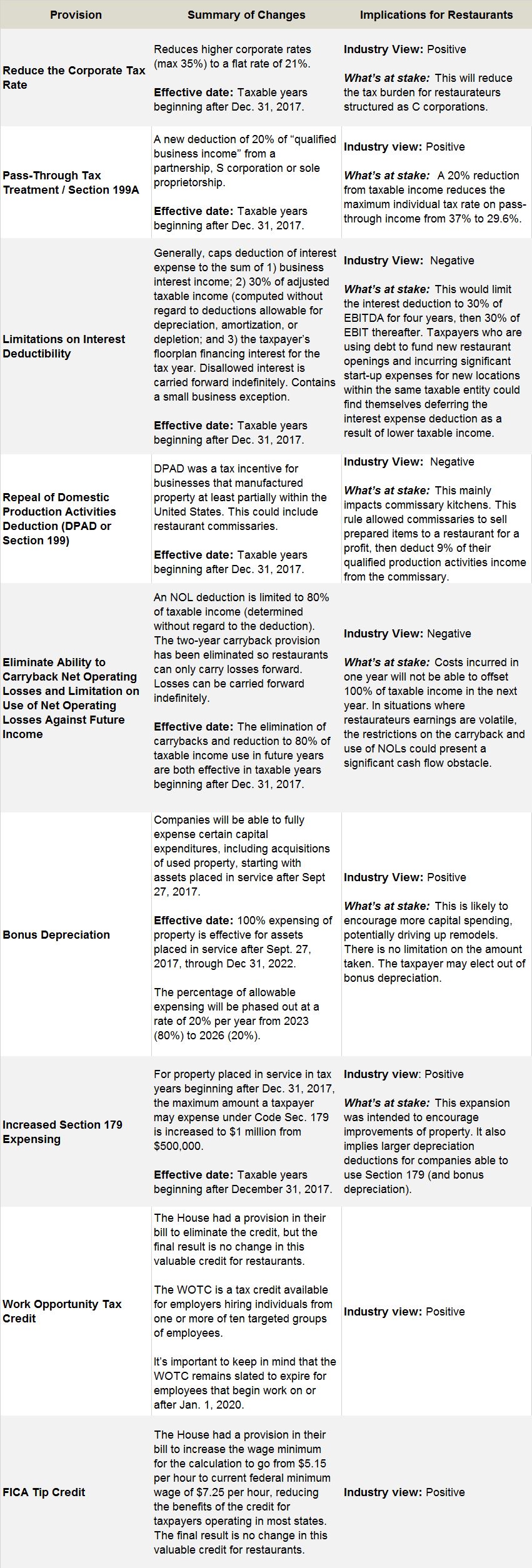

With most of the provisions set to go into effect in 2018, it’s important that the restaurant industry review the changes that occurred during the conference process to understand the impact to their companies.

What Changes Are Coming For Restaurants?

To help organizations navigate the key provisions affecting restaurants, we’ve summarized top considerations and implications below.

Tackling Tax Reform: Initial Steps Restaurateurs Can Take Now

Tax professionals are busy assessing changes caused by this bill, and are waiting for additional guidance on many key provisions to ensure the overall impact is fully understood. In the interim, here are two tips for restaurants to consider to begin tackling tax reform:

- Establish priorities. When considering what to undertake in the coming months, focus on the areas that could have the greatest impact on your organization. Consider your expansion plans and remodels, factoring in the write-offs that are now available. It would also be wise to look at how your businesses tax liability will change: C corporations can measure expected tax payments, and S corporations and partnerships can look at tax distributions to see how that will change this year.

- Initiate tax reform conversations with your tax advisor. Tax reform of this magnitude is the biggest change we’ve seen in a generation, and will require intense focus to understand not only how the changes apply at a federal level, but also to navigate the ripple effect this is likely to have on state taxation as well.

Please look for future communications from Smith and Howard’s tax group on additional details of the new tax bill. Keep in mind that it is important to speak with your tax professional before taking any action. If you have any questions about how the new tax bill can affect your restaurant, contact Mark Abrams at 404-874-6244 or fill out the form below.

How can we help?

If you have any questions and would like to connect with a team member please call 404-874-6244 or contact an advisor below.

CONTACT AN ADVISOR