Back to Resources

Back to Resources

On December 22, just a few weeks following the passage of the Senate’s Tax Cuts and Jobs Act, both legislative branches passed the conference version of the bill, marking the largest change to U.S. tax policy in decades.

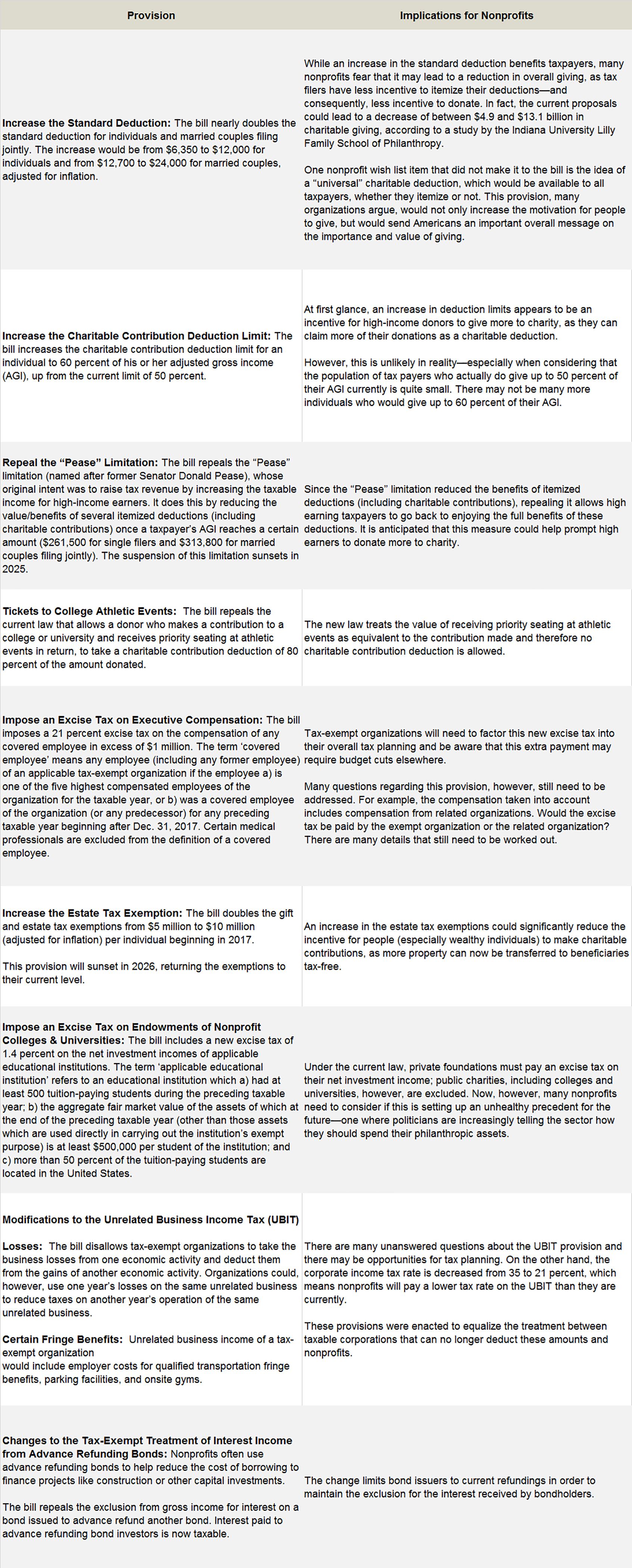

With most of the provisions set to go into effect this year, it’s important that nonprofits review the changes that occurred during the conference process to understand the impact to their organizations.

What Changes are Coming for Nonprofit Organizations?

Reviewing the 1,000-plus pages of the bill is a daunting task for nonprofits.

To help organizations navigate the key provisions affecting nonprofits, we’ve summarized top considerations and implications below.

On the Cutting Room Floor

One provision of particular interest to nonprofits failed to make it to the Conference Committee’s version of the bill—the repeal of the Johnson Amendment. The House bill included a provision that would enable nonprofits to express their favor for a certain political candidate, even under the Johnson Amendment, which is designed to protect 501(c)(3) organizations from the demands from political candidates and donors for political endorsements and campaign contributions.

Reactions to the potential repeal were mixed, with some saying it could make nonprofits vulnerable to political demands by donors, while others thought it provided organization with freedom of speech, but at a level that would still prevent them from becoming political organizations. Although it was not included in the final version of the tax reform bill, the President has long been talking about his desire to lift these restrictions, so we may see this debate resurface in the coming years.

Another provision that was not enacted and could have significantly impacted nonprofits was one that would have limited the royalty exclusion from UBIT.

Looking Forward

After a dramatic push to the finish line, tax reform is finally here. Nonprofits stand to be impacted significantly by various aspects of the bill, and will need to reassess their tax positions for financial reporting purposes.

Nonprofits, which often struggle with a lack of internal capacity, need to be sure to allocate adequate resources to deal with these changes. And, the impact of the bill extends beyond just the provisions for tax-exempt organizations. Many of the changes on the individual level, i.e. nearly doubling the standard deduction and eliminating the estate tax—could leave organizations facing significant cutbacks in donations next year. Comprehensive fiscal management that takes a holistic approach including the tax, audit, fundraising, and executive functions will be more vital than ever in 2018.

Here are three steps nonprofits should take now to tackle tax reform:

- Assemble a team to assess the impact of the legislation on your organization.

- Dig into the data. Assessing the impact of tax reform requires a substantial amount of data to be readily available. Nonprofits need to focus on data collection and computations as soon as possible.

- Initiate tax reform conversations with your tax advisor. Tax reform of this magnitude is the biggest change we’ve seen in a generation, and will require intense focus to understand not only how the changes apply at a federal level, but also to navigate the state requirements as well.

Please look for future communications from Smith and Howard’s tax group on additional details of the new tax bill. Keep in mind that it is important to speak with your tax professional before taking any action. If you have any questions about how the new tax bill can affect your nonprofit organization, contact Marc Azar at 404-874-6244 or fill out the form below.

How can we help?

If you have any questions and would like to connect with a team member please call 404-874-6244 or contact an advisor below.

CONTACT AN ADVISOR