Back to Resources

Back to Resources

Restaurants sales continued to lag in 2016 as uncertainty around the U.S. economic and regulatory environments persisted. Overall, restaurant same-store sales were flat last year. This broader stagnation comes as restaurants report lower traffic counts, in part as a result of market saturation, increased menu prices and declining grocery costs. Restaurants also face challenges associated with evolving consumer preferences and market composition, as smaller chains, independents and chef‑driven concepts expand rapidly.

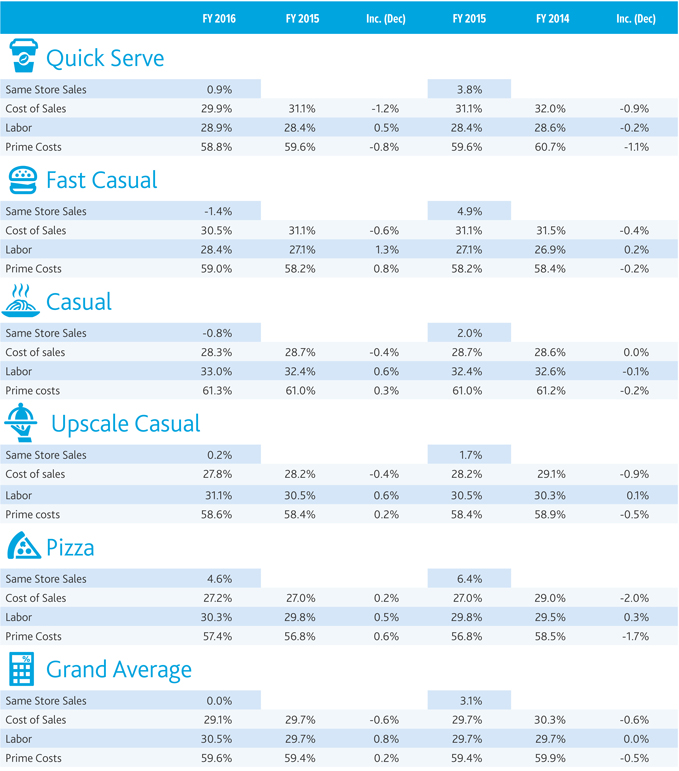

Despite slowed foot traffic, restaurant spending exceeded grocery spending for the first time in 2016, according to Fitch Ratings. As economic indicators post-election have spurred confidence among consumers, operators are vying for a greater slice of consumers’ wallets. The pizza segment experienced the most significant growth in 2016, with a 4.6 percent same-store sales increase. For the ninth consecutive quarter, Domino’s dominated the pizza pack, reporting a 10.4 percent boost last year. The company’s Tweet-to-Order rollout in 2015 and other early digital innovations bolstered the brand’s sustained success. Whether through its mobile app’s one-touch ordering option, Amazon Echo or another platform, 60 percent of Domino’s orders came through a digital channel in 2016, the company reported.

The quick-serve segment saw the second-greatest sales uptick in 2016 with 0.9 percent growth. Harnessing the power of Snapchat, adopting mobile pay and rolling out limited-time menu items, KFC bested its quick-serve competition with a 3.0 percent same-store sales increase in 2016.

A stark contrast to the 4.9 percent growth posted for fiscal year 2015, the fast casual segment reported a 1.4 percent decrease in same-stores sales in 2016. Chipotle’s 20.4 percent decline continued to work against the segment’s average for the year. However, the brand is showing signs of recovery, experiencing a more modest 4.8 percent decline in Q4 2016 compared to the double digit decreases reported for the prior four quarters. Once again, Wingstop and Shake Shack prevailed in the fast casual segment in 2016, with reported increases of 5.4 percent and 4.2 percent, respectively. Wingstop’s CEO cites singularity and simplicity as the keys to its success, while Shack Shack’s growth may be attributed to its new mobile app and rapid physical expansion in high-traffic markets. New on the podium is Panera Bread, which posted a 4.2 percent sales increase in 2016—likely a result of its commitment to high-quality, healthier options.

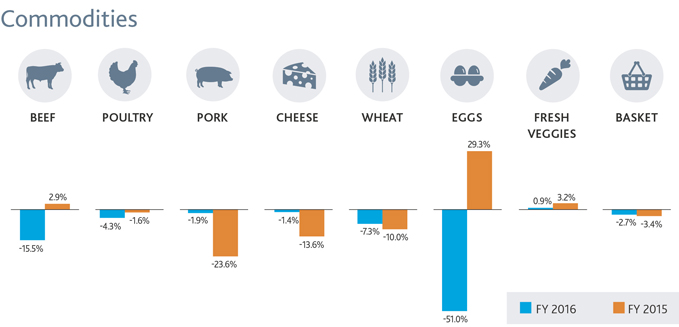

Commodities and cost of sales

With the exception of the pizza segment, which invests heavily in promotional strategies, cost of sales dropped 0.6 percent across the board in 2016, primarily driven by sustained low commodity costs.

Again, the pizza segment is the exception to the rule as it bore the brunt of small upticks in cheese prices throughout 2016. While the average price of cheese is down 1.4 percent from 2015, late summer and early fall months saw prices higher than the 2015 average.

The cost of eggs experienced the most dramatic commodity price reduction, falling more than 50 percent in 2016 following a shortage in the prior year. Meanwhile, beef costs continue to drop, declining 15.5 percent for the year.

Some restaurants are taking advantage of these declines by bulking up dairy and beef offerings on their menus and in promotions, while others are investing in technology to better manage costs and offset higher labor costs.

Labor costs

According to the National Restaurant Association, the industry is expected to remain the nation’s second-largest private sector employer with a workforce of 14.7 million in 2017. But ongoing market oversaturation, current low unemployment levels, higher-than-average job growth, the emergence of digital assistants and proposed regulations make today’s labor market tough to navigate. In fact, labor costs rose 0.8 percent across all segments in 2016, with the fast casual segment enduring the most significant hike.

Although the Department of Labor’s proposed overtime rules were postponed, many restaurants prepared for the changes by preemptively increasing wages. In anticipation of rising health insurance costs and more stringent labor laws, restaurant owners are focused on reducing labor costs. However, rife competition and high turnover rates make it particularly important for employers to effectively incentivize staff.

Looking ahead

With today’s convenience economy and the attractive savings offered by dining at-home, it’s likely that foot traffic will remain flat in the year ahead. To remain afloat, restaurants will need to drive sales by leveraging the very trends that are shaping this evolving consumer behavior.

Restaurants can add value to the at-home dining preferences by expanding delivery options, either through traditional or third-party providers. And overall, the rise of digital is changing the game not only when it comes to delivery, but for all steps in the dining process. According to the NPD Group, digital food ordering has grown 18 percent since last year, accounting for an average of 1.9 billion restaurant transactions annually.

Consumers have the capacity to satisfy all their needs with just a fingerprint—from making food decisions and ordering, to delivery and payment. For restaurants, capitalizing on this reality means investing to match the same level of sophistication, flexibility and efficiency across operations.

FY 2016 Restaurant Industry Scorecard

This article orginally appeared in BDO USA LLP’s Restaurant Benchmarking Update – March 2017. Copywrite 2017 BDO USA, LLP. All rights reserved. www.bdo.com.

How can we help?

If you have any questions and would like to connect with a team member please call 404-874-6244 or contact an advisor below.

CONTACT AN ADVISOR