Back to Resources

Back to Resources

Update: On December 22, 2017, President Trump signed the Tax Cuts and Jobs Act into law. On December 19, the House approved the final tax bill, sending it to the Senate who approved it shortly afterwards.

The details of the final bill are included below and come after weeks of negotiations and revisions between the House and Senate.

Timing: Under the conference bill, many tax provisions for individual taxpayers, including the new tax rates, will go into effect January 1, 2018, and will expire at the end of 2025. Without legislative action by 2025, the law will go back to the way it is as of this date (12/19/17).

Corporate Rate: The corporate rate would be cut to 21 percent starting January 1, 2018.

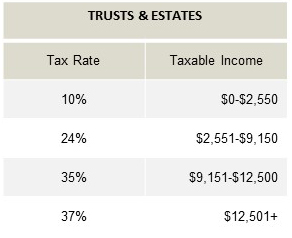

Pass-through Taxation: Pass-through entity owners that meet certain conditions would be eligible for a 20 percent deduction on their business income. Pass-through owners who file jointly and earn at least $315,000 in business profits are subject to limitations on the deduction. The restriction is based on how much the pass-through pays in wages or invests in equipment and machinery. Service businesses, such as law and accounting firms, are eligible for the deduction if owners are under the threshold. The conference agreement provides that trusts and estates are eligible for the 20 percent deduction under the provision with limitations based on wages paid. The bill also includes a provision that would limit a partnership’s ability to offset passive income—dividends or interest or rental income—with losses from an active trade or business in excess of $500,000 for joint filers or $250,000 for an individual.

International Regime: The bill would move toward a territorial system, and would include a base erosion and anti-abuse tax (BEAT), which requires U.S. multinationals making “excessive” deductible payments to their foreign affiliates to pay a 10 percent tax on their income without those deductions, after a one-year, 5 percent transition rate. In 2026, the rate would increase to 12.5 percent. Some credits, such as the low-income housing credit and several energy credits under tax code Sections 45 and 48, count against the BEAT up to an 80 percent limit, ensuring that some tax is paid, a Republican aide said. The aide also said that the final bill clarifies the treatment of reinsurance and adjusts the thresholds for the BEAT to 3 percent generally and 2 percent for financial institutions. The plan would also impose a tax on global intangible low-taxed income (GILTI). Overseas profits would be taxed automatically at a 15.5 percent rate for cash assets and 8 percent rate for illiquid assets.

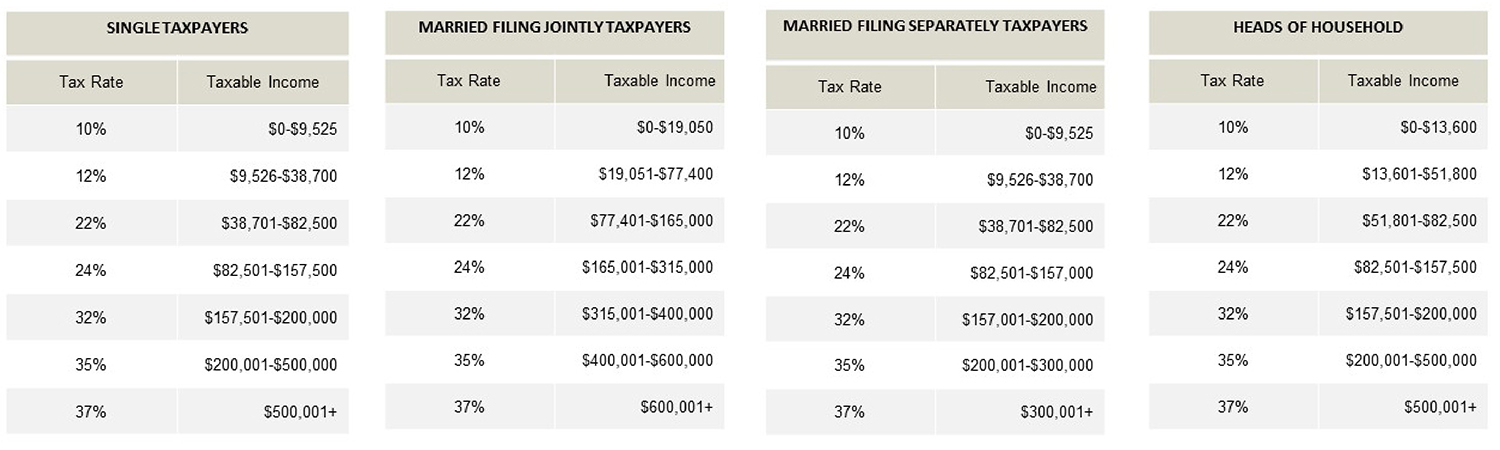

Individual Rates: The top individual rate would be 37 percent for individuals earning $500,000 and above and joint filers earning at least $600,000. We will still have seven tax brackets, but with revised rates of 10, 12, 22, 24, 32, 35, and 37 percent. The tax bill would nearly double the standard deduction—to $24,000—for a couple filing jointly. The tax rates and standard deduction expansion would expire in 2026. The standard personal exemption of $4,050 for yourself, your spouse and each of your dependents will be eliminated.

Capital Gains: Capital gains rates are unchanged, but brackets will be adjusted and FIFO (first in/first out) sales rules will not apply.

Interest Deductibility: The legislation would limit the interest deduction to 30 percent of a company’s earnings before interest, tax, depreciation, and amortization (EBITDA) for four years. After that, the bill would limit the deduction to 30 percent of earnings before interest and taxes (EBIT). The conference agreement would exempt taxpayers with average gross receipts of $25 million or less from the interest limitation. It would also exempt car dealers using floor plan financing loans to fund their inventory.

Business Expensing: Full expensing of new and used capital investments would be permitted for five years. After 2022, the 100 percent allowance would be phased down by 20 percent each year. Section 179 expensing, which doubles the amount eligible for the special small business investment write-offs, would also be made permanent.

Private Activity Bonds: Private activity bond provisions used to finance infrastructure would be retained.

Corporate Alternative Minimum Tax: The corporate AMT would be repealed.

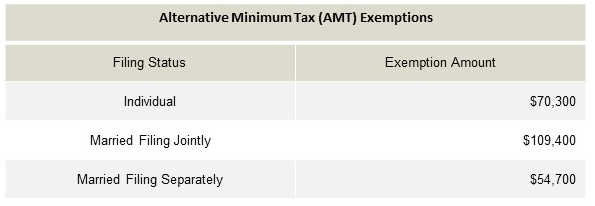

Individual Alternative Minimum Tax: The individual AMT would be increased to apply to individual filers earning more than $500,000 or joint filers earning $1 million or more and are permanently adjusted for inflation. In the most recent proposal, AMT exemption amounts would be as follows:

Estate Tax: The exemption would be doubled for estates worth about $11 million for individuals and $22 million for couples. The exemptions would revert to current levels after 2025.

State and Local Tax Deduction: Taxpayers would be allowed to deduct up to $10,000 of state and local taxes paid—property taxes and either income taxes or sales taxes. Amounts paid in 2017 for state or local income tax which is imposed for the 2018 tax year will be treated as paid in 2018, disallowing the ability to pre-pay 2018 taxes to avoid the cap.

Mortgage Interest Deduction: The bill would preserve the deduction for existing mortgages and cap it at $750,000 for newly purchased homes starting Jan. 1, 2018. The plan would also end the deduction for interest on home equity loans.

Charitable Deduction: the charitable donation deduction will remain in place with some adjustments upwards on limits for cash gifts. No adjustment to the charitable mileage rate was made.

Child Tax Credit: The child tax credit would be increased to $2,000 per child, with up to $1,400 of it being refundable.

College Endowments: The proposal would set a 1.4 percent excise tax on the net investment income of private university and college endowments. The tax applies to schools with assets of more than $500,000 per tuition-paying student.

Carried Interest: The legislation would impose a three-year holding period requirement for partnership interests received in connection with performing services, to be eligible for the long-term capital gain tax rate. The change would triple the length of time an asset must be held to qualify for the lower rate. Carried interest is the portion of an investment fund’s profit—usually a 20 percent share—that is paid to investment managers.

Medical Expense Deduction: The bill would allow taxpayers to deduct medical expenses exceeding 7.5 percent of adjusted gross income for 2017 and 2018.

Individual Mandate: The plan would zero out the penalties for not obtaining health coverage under the Affordable Care Act’s individual mandate.

For questions, please contact your Smith and Howard tax professional or Smith and Howard’s Tax Practice Leader, Debbie R. Torrance.

Sources: BNA Daily Tax Report, Tax Cuts and Jobs Act House and Senate Committees’ Policy Highlights, Forbes

How can we help?

If you have any questions and would like to connect with a team member please call 404-874-6244 or contact an advisor below.

CONTACT AN ADVISOR