Back to Resources

Back to Resources

In August 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update 2016-14, Presentation of Financial Statements of Not-for-Profit Entities (“ASU”). FASB’s agenda was separated into two phases of which Phase 1 has been included in the ASU.

Currently, the FASB does not have a projected timeline for Phase 2. Phase 1 of the financial statement project was initiated in 2011 by the FASB to ensure nonprofit reporting continues to meet the dynamic needs of users. It is important to note that a key objective for this ASU is to allow nonprofit entities to tell their financial story and improve the usefulness of information provided to donors, grantors and other users of the financial statements.

Since the issuance of the ASU, many clients and board members have posed the question, “How will these new statements and disclosure requirements be presented and what should we do now, prior to adoption?” While the ASU provides presentation and disclosure examples which help answer these questions, Smith and Howard will be providing a series of in-depth articles on the changes to financial statement presentation and disclosures set forth in the ASU. At the conclusion of the series, practical recommendations for how to prepare for the changes will be provided. Until the second phase is issued by the FASB, our series will include only the changes set in Phase 1 and will cover the following topics:

- Presentation of Net Assets

- Liquidity and Available Resources

- Functional Expense Reporting and Investment Return Disclosure

- Cash Flow Statement – Direct vs. Indirect Method

- Operating Measure – (optional)

Net Asset Categories

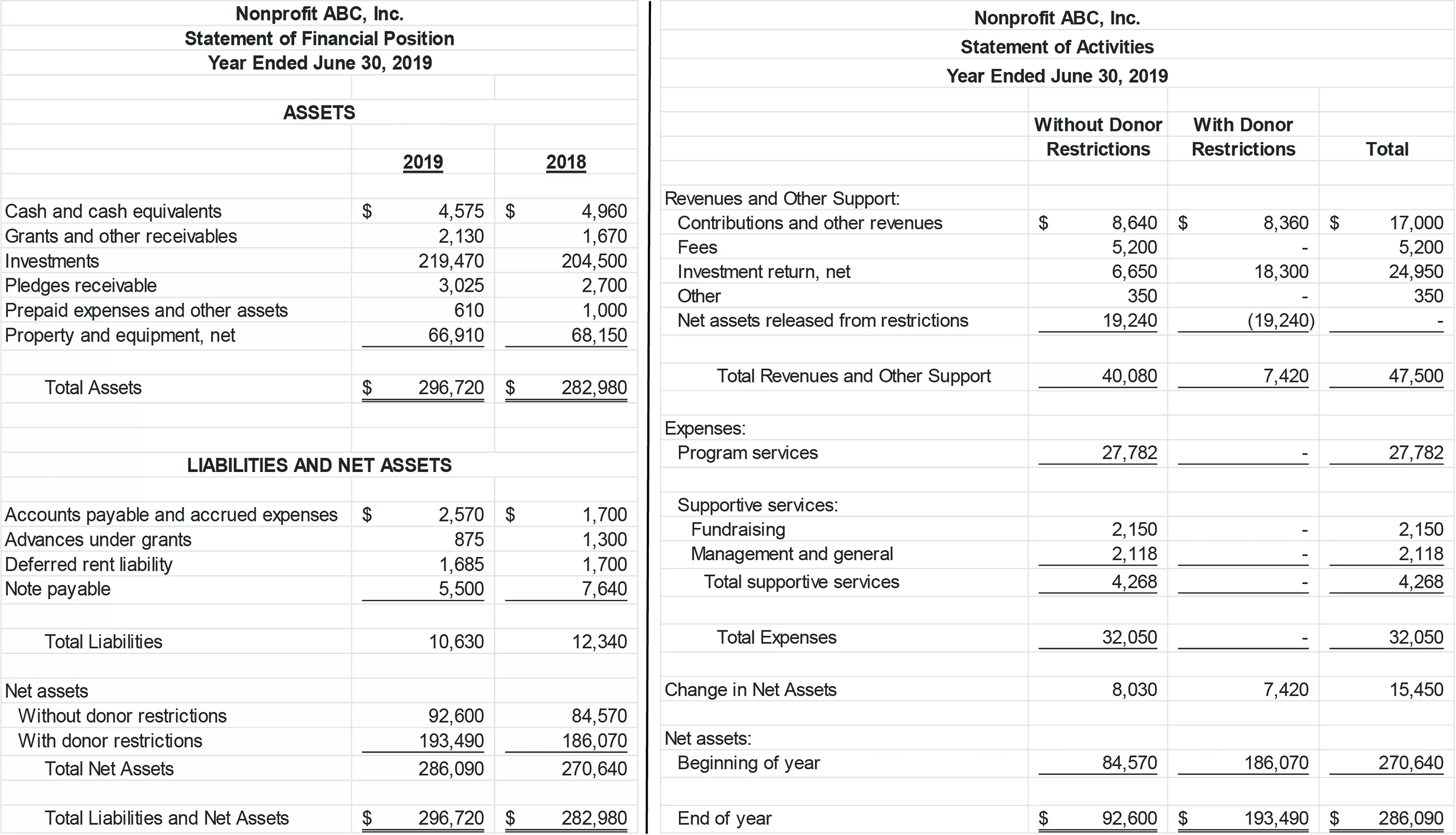

This article will focus on the significant changes to net assets and is the largest impact of the ASU to nonprofit financial statements. The ASU replaces the current three classes of net assets (unrestricted, temporarily restricted and permanently restricted) with two new classes – net assets with donor restrictions and net assets without donor restrictions. These categories are to help the users of the financial statement better understand the restrictions. The two categories are the minimum disclosure requirement. If a nonprofit feels that more information is required for the reader to understand the financials, then it is acceptable to disaggregate the information further. Below is an example of a statement of financial position and corresponding statement of activities with the changes implemented.

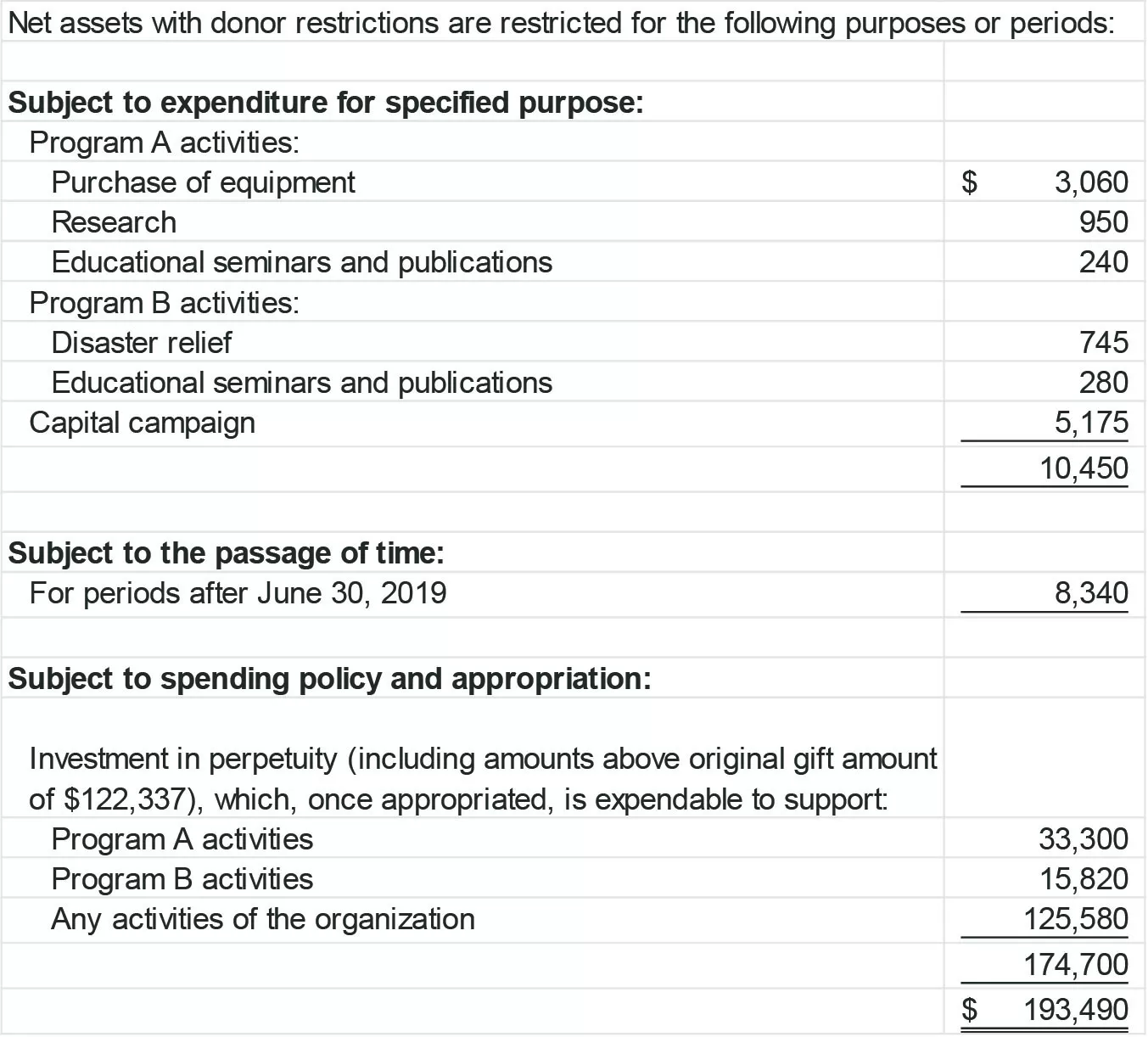

Even though the currently defined temporarily restricted and permanently restricted net assets are now combined into “with donor restrictions” on the statement of activities and the statement of financial position, disclosures are still required to include information about the nature and amounts of donor imposed restrictions, including time, purpose and perpetuity. Below is an example of a footnote disclosure which replaces the two disclosures currently required:

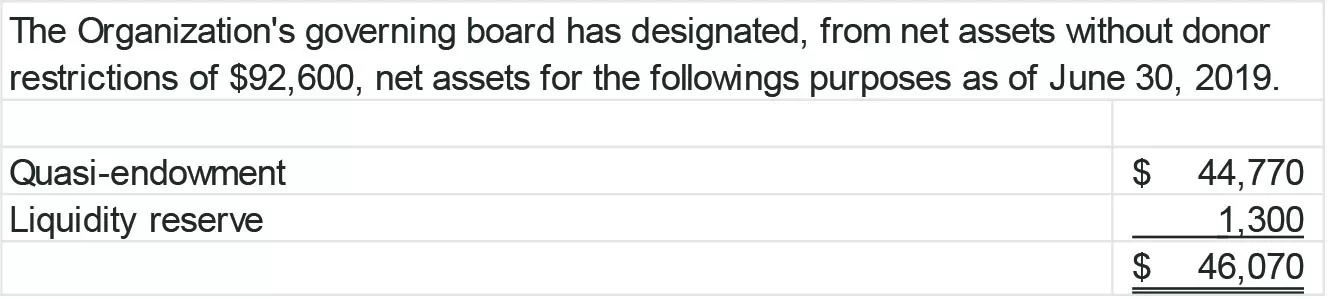

Board Designated Funds

The ASU now requires disclosures on the amount and purpose of Board Designated funds. This information will highlight to the user of the financial statements the board decision on the use of net assets without donor restrictions. The ASU provides the following example:

Underwater Endowments

Previously, underwater endowments required a reclassification out of unrestricted net assets to temporarily restricted net assets and the amount of funds with deficiencies was required to be disclosed. With the new ASU, underwater endowments will no longer be reclassified out of donor restricted funds, but will be included in donor restricted endowment funds and additional disclosures will be required. If a nonprofit has underwater endowments, the required disclosures include:

a) Fair value of the underwater endowment funds

b) The original endowment gift amount or level required to be maintained by donor stipulations or by law that extends donor restrictions

c) The amount of the deficiencies of the underwater endowment funds

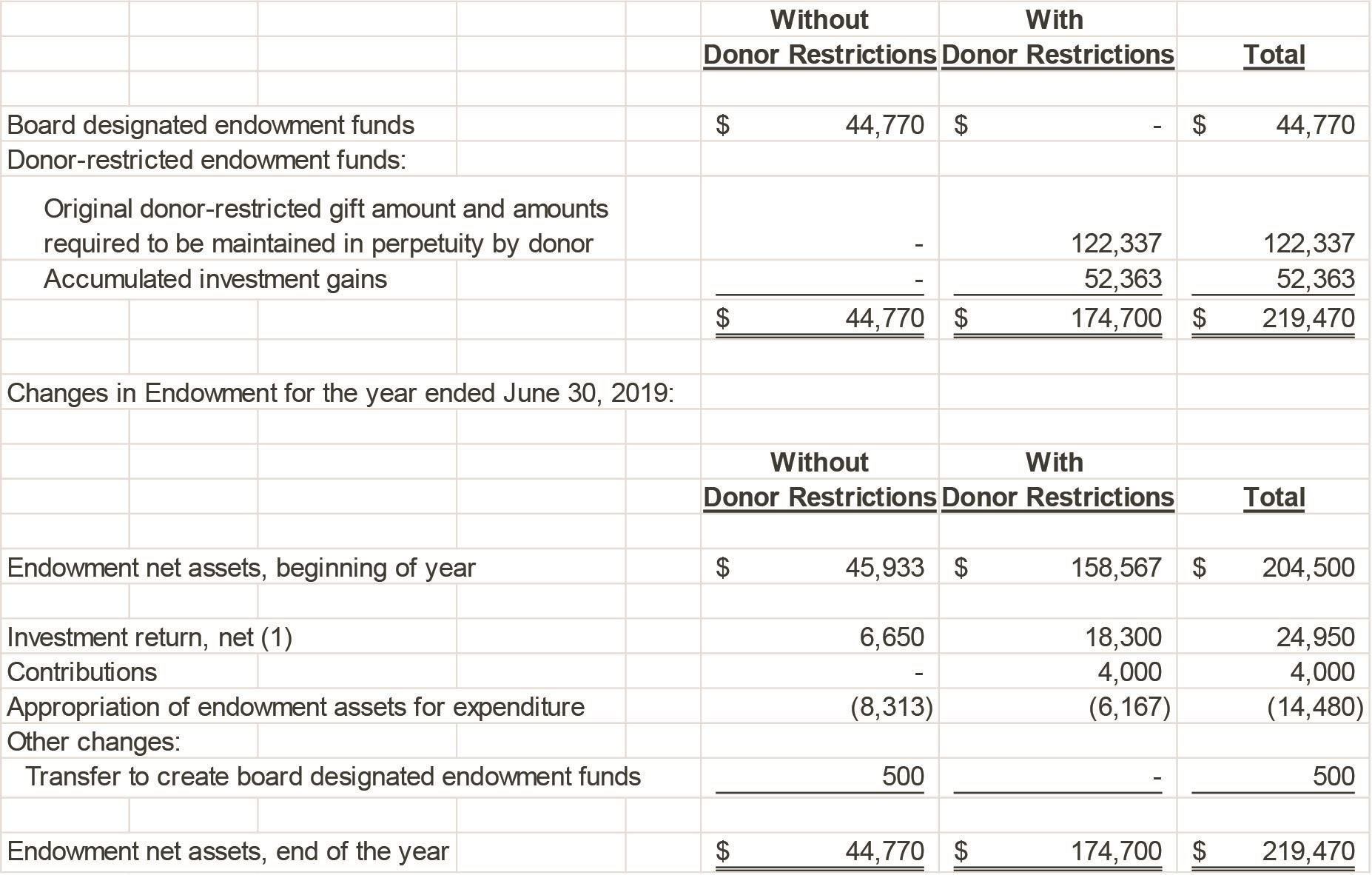

Below is an example of the endowment fund roll forward with the new net asset categories.

(1) Note the change in the investment return presentation which will be described in the article on Functional Expense Reporting and Investment Return Disclosure

The ASU also requires a nonprofit to include a description of the governing board’s interpretation of the law or laws that underlie the nonprofit’s net asset classification of donor restricted endowment funds, including its interpretation of the ability to spend from underwater endowment funds and any actions taken during the period concerning appropriation from underwater endowment funds. Below are disclosure examples that could be used when a nonprofit has underwater funds:

Underwater Endowment Funds – From time to time, the fair value of assets associated with individual donor restricted endowment funds may fall below the level that the donor or UPMIFA requires the Organization to retain as a fund of perpetual duration. Deficiencies of this nature exist in three donor restricted endowment funds, which together have an original gift value of $3,500, a current fair value of $3,300, and a deficiency of $200 as of June 30, 2019. These deficiencies resulted from unfavorable market fluctuations that occurred shortly after the investment of new contributions for donor restricted endowment funds and continued appropriation for certain programs that was deemed prudent by the Board of Trustees.

Additional wording to the spending policy:

The Organization has a policy that permits spending from underwater endowment funds depending on the degree to which the fund is underwater, unless otherwise precluded by donor intent or relevant laws and regulations. The governing board appropriated for expenditures $75 from underwater endowment funds during the year, which represents 3% of the 12 quarter moving average, not the 5% it generally draws from its endowment.

Expiration of Capital Restrictions

Lastly, capital gifts that are restricted for the acquisition or construction of long-lived assets will be required to be released from restriction when the asset is placed in service rather than recognizing the expiration of donor restrictions over time, absent explicit restriction from the donor. Therefore, nonprofits will no longer be able to release capital restrictions to match the depreciation expense or release capital restrictions as the project is on-going, unless explicitly instructed by the donor.

Effective Dates:

The ASU is effective for fiscal years beginning after December 15, 2017, requiring nonprofits with 2018 calendar year ends and 2019 fiscal year ends to adopt at those respective times. Nonprofit entities are allowed to early adopt, but if presenting comparative financials, each year presented must reflect the changes, with the exception of the functional expense requirement and the liquidity and availability of resource requirement.

Questions? Please contact Kimberly Bland at 404-874-6244 or contact us online.

How can we help?

If you have any questions and would like to connect with a team member please call 404-874-6244 or contact an advisor below.

CONTACT AN ADVISOR