Back to Resources

Back to Resources

Every year, manufacturing contributes more than $2 trillion to the American economy, according to NAM (National Association of Manufacturers). It is also estimated that for every dollar spent in manufacturing, $1.37 is added to the economy, giving the industry the highest multiplier effect of any economic sector. In the midst of a resurgence, the industry has the potential to provide immense opportunity for the American economy and workforce if it can continue to evolve in response to rapidly changing regulatory, economic and technological landscapes. Doing so will, however, require determination, innovation and management of rising risks.

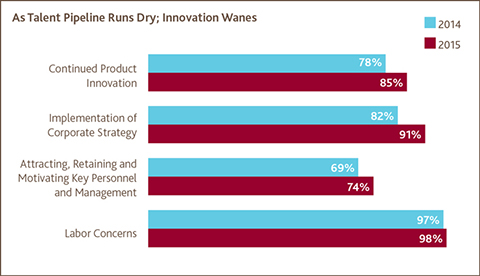

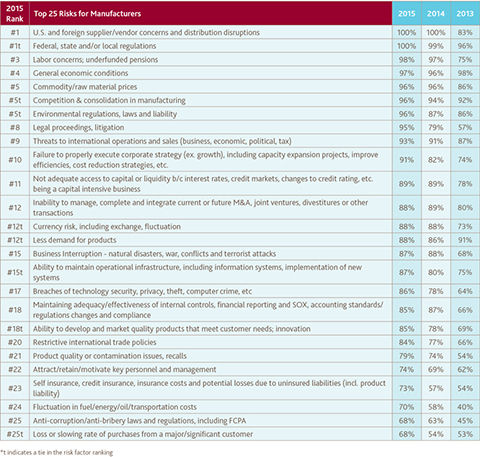

As the manufacturing industry grows, concern over the widespread talent shortage is escalating. Ninety-eight percent of manufacturers mentioned risks related to labor, up from 97 percent in 2014 and 75 percent in 2013.

Manufacturers face a one-two punch of a struggle to attract workers coupled with the approaching retirement of much of the talent on the factory floor and in the C-suite. The U.S. Census Bureau estimates that by 2030, more than 20 percent of Americans are projected to be aged 65 and over, compared with 13 percent in 2010 and 9.8 percent in 1970. As leading innovators and strategists reach retirement, 74 percent of manufacturers mentioned concerns around attracting, retaining and motivating key personnel and management, up from 69 percent in 2014 and 62 percent in 2013.

With many jobs to fill now and in the future, manufacturers and their employees feel the pinch to simultaneously execute business strategy and create next-generation product. Risks related to the implementation of corporate strategy are mentioned by 91 percent of manufacturers, up from 82 percent in 2014 and 74 percent in 2013. Continued product innovation is also a growing risk, mentioned by 85 percent of manufacturers, up from 78 percent in 2014 and 69 percent in 2013.

Supply Chains Are Only As Strong As Their Weakest Link

Supply chain concerns, including disruptions or issues from suppliers and vendors, remained the most-cited risk for manufacturers for the second year in a row, mentioned by 100 percent of manufacturers. It should come as no surprise, given that manufacturers’ supply chains were put through their paces with this year’s West Coast port strike, as well as record-breaking snowfall on the East Coast, among other extreme weather conditions. According to CNN, the West Coast port strike cost the economy approximately $2.5 billion dollars per day.

Furthermore, business interruptions, including natural disasters, were cited by 87 percent of manufacturers. To help mitigate the risk of extreme weather and natural disasters that could be connected to climate change, the EPA is working to strengthen industry environmental regulations; however, many manufacturers are concerned about the impact that such regulations might have on business. Ninety-six percent of companies mentioned this risk, up from 87 percent in 2014 and 86 percent in 2013.

Regulatory Compliance Continues As A Challenge

According to The Manufacturing Institute’s 2012 “Cost of Regulatory Compliance,” manufacturers spend an estimated $192 billion each year to abide by economic, environmental and workplace safety regulations and ensure tax compliance – roughly equivalent to an 11 percent “regulatory compliance tax.”

In this challenging environment, risks related to federal, state or local regulations, including tax laws, are mentioned by 100 percent of companies, tying with supply chain concerns as the most-cited risks in the industry. Intensified state enforcement and the push to generate state revenue could be driving this concern, as there appears to be increased scrutiny of manufacturers’ reporting, specifically around unclaimed property.

Manufacturers are not just concerned about regulations of domestic activities. As more manufacturers conduct business abroad, particularly in high-risk markets, mentions of risks related to anti-corruption/anti-bribery laws and regulations, including FCPA, are increasing. Sixty-eight percent of companies cite these risks, up from 63 percent in 2014 and 45 percent in 2013.

Stronger Dollar Could Keep Manufacturers from International Exploration

The dollar’s climb to 12-year highs in the first quarter of 2015 has stimulated U.S. production and domestic spending, but manufacturers should be wary of an impending “chill,” according to analysts at The Wall Street Journal. International business and exports could suffer as foreign buyers pull back. Manufacturers that service international companies may also take a more cautious approach to expansion. And increasingly, manufacturers are looking for ways to offset potential financial losses from reduced international activity.

These economic challenges abroad that show no sign of slowing down align with risks that increased in mention within the RiskFactor Report. Threats to international operations and sales are mentioned by 93 percent of companies, up from 91 percent in 2014 and 87 percent in 2013. Restrictive international trade policies, such as import quotas, capital controls and tariffs, also experienced an increase, cited by 84 percent of companies, up from 77 percent in 2014 and 66 percent in 2013. Currency risk, including exchange and fluctuations, remained a concern for 88 percent of manufacturers.

IP Protection Heightens Data Security Risks

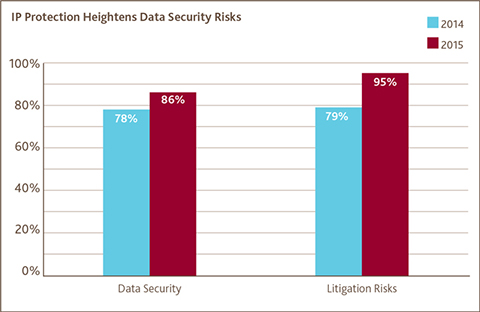

High-profile data breaches at large companies, including Home Depot and Sony Pictures, have catapulted risks related to IT infiltrations to the top of manufacturers’ list of concerns. Research firm Gartner predicts that annual information security spending will grow this year to $76.9 billion from $71.1 billion a year ago. Ensuring the security of IT systems is especially important for manufacturers, as they must protect their intellectual property in order to protect competitive advantages. Eighty-six percent of manufacturers cite risks related to data security this year, up from 78 percent in 2014. Moreover, the protection of intellectual property and rising concerns around security may also contribute to the spike in mention of litigation risks (95 percent, up from 79 percent in 2014).

Fabricated Metal

Driven largely by demand for automobiles, aerospace equipment and machinery, fabricated metal manufacturing is benefiting from strong economic fundamentals, increasing consumer confidence and a strengthened dollar. However, the industry still faces significant risks, seven of which were mentioned by 100 percent of the manufacturers in this category, including supply chain, regulation, labor concerns, economic conditions, competition, environmental regulations and failure to properly execute corporate strategy.

Arguably the most impactful risk to the industry is the fluctuation in energy costs. Eighty percent mentioned this risk, up from 55 percent in 2014. This increase could be attributed to the recent wide fluctuation of oil prices, which is now hitting manufacturers that service the oil and gas industry the hardest.

The sector is also grappling with a struggling export business due to weakened currency abroad. A staggering pipeline of exports, in an industry already known to be extremely competitive, might not bode well for its performance in the global marketplace. One hundred percent of fabricated metal manufacturers cited competition in the industry, consolidation and pressure on pricing and margins as risks, and 95 percent mentioned threats to international operations and sales (business, economic, political, tax). Additionally, 100 percent mentioned expansion as a risk, up from 80 percent in 2014.

Food Processing

Among food manufacturers, eight risks sit atop the pack: supply chain, tightening regulation, economic conditions, commodity costs, competition, business interruption, environmental regulation and reduced product demand.

With sales closely tied to evolving consumer preferences, many food manufacturers are changing their processed ways and introducing healthier options to keep up with the demand for organic and wholesome options. U.S. industrial production of snack foods and other miscellaneous food products fell slightly in 2014, following four years of post-recession growth. Consumers’ shifting eating habits could be attributed to the White House’s five-year Let’s Move campaign focused on encouraging healthier lifestyles, as well as to the increased prevalence of health and dietary sensitivities among Americans – according to the National Foundation for Celiac Awareness, research estimates that 18 million Americans suffer from gluten sensitivity.

These widespread dietary shifts could also explain concerns over reduced product demand, mentioned by 100 percent of companies, up from 90 percent in 2014. Additionally, mentions of risks around the ability to develop and market quality products that meet customer needs also rose. Ninety-five percent of companies mentioned this risk, up from 80 percent the year prior.

Beyond racing to meet ever-changing consumer preferences, food processors are also focused on expanding across the globe to capitalize on international communities’ growing appetite for Western foods. Ninety percent of food processors mentioned threats to international operations as a risk, up from 80 percent in 2014. Ninety percent also mentioned risks related to their ability to execute strategy, up from 75 percent in 2014.

As food processors are forced to grow their supply chains across international borders, they could also become more susceptible to the challenges brought on by extreme weather. Eighty-five percent mentioned this risk, up from 60 percent last year. According to the Union of Concerned Scientists, dangerously hot weather is already occurring more frequently than it did 60 years ago – and scientists expect heat waves to become more frequent and severe as global warming intensifies.

Machinery

Three risks are mentioned by 100 percent of machinery manufacturers, including supply chain issues, regulatory risks, and labor concerns.

The talent shortage could be especially damaging to this sector, which depends on skilled laborers to operate the advanced tools responsible for developing highly engineered and computerized machinery. Discouraging entry into the sector may be the industry’s steep injury rate, which is 20 percent higher than the national average. The dangerous work environment, which can involve exposure to toxic materials, burning of fossil fuels and potentially hazardous procedures, might also be a contributing factor that grew the mention of uninsured liabilities as a risk by 70 percent of companies, up from 65 percent in 2014. Similarly, 80 percent of companies mentioned retaining key personnel as a risk, up from 70 percent in 2014 and 60 percent in 2013.

Adding to the talent crisis, the industry is also feeling the effects of fluctuating gas prices that could be contributing to reduced drilling activities and, in turn, diminished demand for machinery. Sixty-five percent mention energy costs. While this phenomenon is mostly concentrated within certain regions, it is impacting one of the industry’s top producing states: Texas.

In addition, the machinery industry is heavily reliant on export business and the combination of a strengthened dollar and weakened currency abroad could result in manufacturers being less competitive in overseas markets. U.S. machinery exports declined about 2 percent in the first two months of 2015, compared to the same time in 2014.* Threats to international operations and sales were cited by 93 percent, up from 91 percent last year.

Plastics and Rubber

Several major risks were mentioned by 100 percent of plastics and rubber manufacturers, including supplier issues, tightening regulations and commodity costs.

The industry finally has the benefit of financial flexibility, thanks to lower electricity costs fueled by deflated oil prices and an abundance of natural gas. The savings experienced by plastics and rubber manufacturers could be allowing for greater investment in the future, specifically around talent and operations. According to The Washington Post, the industry is experiencing a mini-resurgence of U.S. plastics manufacturing. The sector has added 60,000 jobs since mid-2009, a 12 percent increase. Activity is also increasing in rubber manufacturing: according to the NASDAQ, production rose in several chemistry end-user markets in April, including, among others, rubber products.

As the industry is reinvigorated, a growing number of positions are becoming available and companies could be fearful of being unable to fill them with the skilled workers they need. One hundred percent of plastics and rubber manufacturers mentioned talent as a risk, up from 90 percent in 2014. Furthermore, 90 percent mentioned retaining key personnel, up from 80 percent in 2014. One contributing factor to the challenge of holding onto talent could be the industry’s hazardous working conditions. The industry injury rate is about 30 percent higher than the U.S. average, and could be attributed to the presence of hazardous chemicals in production processes.

The mention of tightening environmental regulations also experienced a significant spike. Ninety percent mentioned this risk, up from 70 percent in 2014. The chemicals added to some plastics bring up challenges avoiding harmful air pollution and ground contamination. Concerns around environmental regulations could also be linked to the increase in mention of the ability to expand internationally. Manufacturers conducting business internationally face constantly evolving health and safety standards that can differ wildly between markets and can be quite challenging to navigate. Ninety percent of companies mentioned threats to international operations, up from 85 percent in 2014.

Transportation Equipment

Five risks are mentioned by 100 percent of companies surveyed, including supply chain, regulations, economic conditions, financial reporting and cyber security.

It is to be expected that the supply chain continues to be a concern cited by 100 percent of companies for the second year running. The industry depends on a high level of supply chain management and coordination. The former could become more of a risk as the booming industry expands internationally thanks to greater consumer confidence, a strengthened dollar and low gas prices. Global growth might explain the mention of threats to international operations and sales holding steady at 95 percent since 2013.

Driving the increase of cyber security concerns, mentioned by 100 percent of companies, could be recently proposed legislation mandating that car companies and third-party vendors be competent in detecting, reporting and responding to real-time hacking events. It also requires that drivers be made aware of data collection and transmission, and of how that information is being used. According to a report by U.S. Senator Ed Markey, just two automobile manufacturers of the 16 surveyed could describe how they would respond to a real-time infiltration of a vehicle. This is uncharted territory for auto manufacturers, and these new regulations could be responsible for the jump in mention of these risks, up from 90 percent last year.

As cyber security grows as a risk, so too does litigation. Ninety-five percent of companies mentioned the potential for legal proceedings and litigation, up from 80 percent last year. A driving concern could be the industry’s susceptibility to lawsuits, especially those related to recalls, as evidenced by the recent recall of 34 million Takata vehicles in the United States manufactured by 10 different automakers.

Looking for more information about accounting for manufacturing businesses? Contact J. Sean Spitzer at 404-874-6244 or fill out our form for more information.

How can we help?

If you have any questions and would like to connect with a team member please call 404-874-6244 or contact an advisor below.

CONTACT AN ADVISOR