Back to Resources

Back to Resources

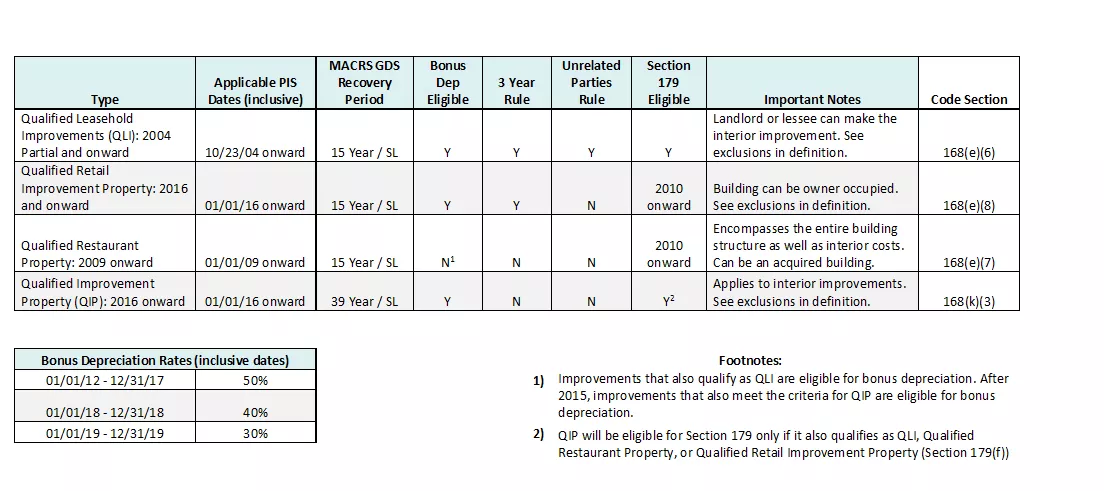

The following quick reference chart provides a basic outline on how to calculate depreciation on certain improvements, equipment and/or tangible property and discusses what qualifies for bonus and/or Section 179. Further, it provides rules and definitions of qualified leasehold improvements, qualified restaurant property and qualified improvement property.

Definitions:

3 Year Rule: The improvements must have been placed in service by any taxpayer more than three years after the date the building was first placed into service.

Unrelated Party Rule: Improvements must be made subject to a lease between unrelated parties (see code section 1504). Can be made by lessees, sub-lessees or lessors to an interior portion of a nonresidential building. Parties are related when there is more than 80% ownership shared between them.

Qualified Leasehold Improvement Property (QLI)A 2001-onward: Any improvement to an interior portion of a building which is nonresidential real property if— (i) such improvement is made under or pursuant to a lease (I) by the lessee (or any sublessee) of such portion, or (II) by the lessor of such portion, (ii) such portion is to be occupied exclusively by the lessee (or any sublessee) of such portion, and (iii) such improvement is placed in service more than 3 years after the date the building was first placed in service. (B) Certain improvements not included. Such term shall not include any improvement for which the expenditure is attributable to— (i) the enlargement of the building, (ii) any elevator or escalator, (iii) any structural component benefiting a common area, and (iv) the internal structural framework of the building.

Qualified Retail Improvement Property 2009-onward: Any improvement to an interior portion of a building which is nonresidential real property if— (i) such portion is open to the general public and is used in the retail trade or business of selling tangible personal property to the general public, and (ii) such improvement is placed in service more than 3 years after the date the building was first placed in service. QRIP shall not include any improvement for which the expenditure is attributable to— (i) the enlargement of the building, (ii) any elevator or escalator, (iii) any structural component benefitting a common area, or (iv) the internal structural framework of the building.

Qualified Restaurant Property 2009-onward: Any section 1250 property which is (i) a building or improvement to a building — if more than 50% of the building’s square footage is devoted to preparation of, and seating for on-premises consumption of, prepared meals, and (ii) if such building is placed in service after December 31, 2008.

Qualified Improvement Property (QIP) 2016-onward: (A) Any improvement to an interior portion of a building which is nonresidential real property if such improvement is placed in service after the date the building was first placed in service. (B) Certain improvements not included. Such term shall not include any improvement for which the expenditure is attributable to— (i) the enlargement of the building, (ii) any elevator or escalator, (iii) the internal structural framework of the building.

Thus, structural components that can qualify as qualified improvement property include, but aren’t limited to, (1) cooling, heating, lighting, electrical, plumbing or ventilation items, including related energy management systems, (2) permanent floor coverings, (3) fire protection and alarm systems, (4) many types of doors, (5) ceilings not needed for building support or stability, (6) permanent but non-load bearing walls, (7) exit route signs, (7) woodwork, (8) rest-room accessories and partitions, and (9) building security items.

Other Notes:

A) Tenant improvements that include costs for HVAC rooftop units are excluded from the definition of Qualified Leasehold Improvements (QLI), Qualified Retail Improvements, and Qualified Improvement Property (CCA 201310028).

B) Restaurant tenant improvements located within a multi-tenant building where 50 percent of the building’s total square footage is not leased to restaurants, do not meet the definition of Qualified Restaurant Property.

C) HVAC systems qualify for Bonus Depreciation and Section 179.

How can we help?

If you have any questions and would like to connect with a team member please call 404-874-6244 or contact an advisor below.

CONTACT AN ADVISOR