Back to Resources

Back to Resources

Whether you’re scaling a small business or expanding a large enterprise, it always helps to get a tax break for the work you’re doing to grow local economies.

Most states offer job creation tax credits that defray a new employee’s wages for their first few years. Qualifying for a job creation tax credit can save a business thousands for each new employee, making it a boon for growing employers.

What is a Job Creation Tax Credit?

Job creation tax credits are state-administered incentives that reward businesses for creating jobs in the state. Most states offer job creation tax credits to companies that create solid, well-paying jobs in the state.

Eligibility requirements for job creation tax credits differ by state. Because these credits aim to improve residents’ livelihoods, states often count only full-time jobs that meet specific wage criteria.

Like all state tax credits, job creation tax credits offer a dollar-for-dollar reduction in your business’s state tax bill. The exact value of the credit also differs greatly by credit and state. Some credits, such as Louisiana’s enterprise zone tax credit, provide a fixed amount per job created, while others offer a percentage of wages paid to employees in these new roles over a specified period. And yet other credits, such as West Virginia’s economic opportunity credit, provide full reimbursement of new wages paid up to a percentage of the company’s income tax liability for the year.

Let’s say you open a new facility in Maryland that creates 75 new jobs. If your facility qualifies for the state’s Job Creation Tax Credit, your business may receive a $225,000 tax credit — $3,000 for each new job created in the state. That amount goes up to $5,000 per new job if your facility is in a priority area.

What Do I Need to Do Before I Claim a Job Creation Tax Credit?

Taking a job creation tax credit requires some planning. When you work with a Smith + Howard tax advisor to identify tax credits available to your business, expect questions on the following topics.

Consider Your Business’s Growth Plans

Because many states’ job creation tax credits are time-limited, it’s important to pick the right time to start the clock. For example, if you have the foresight to know that you’ll create only five jobs this year but 50 new jobs in the following year, it may be worth waiting to start claiming the credit next year.

Understand Your State’s Job Creation Tax Credit Eligibility Requirements

Tax law isn’t known for its readability. Before banking on a job creation tax credit, make sure your added headcount qualifies for the state-provided incentive. To be sure your business can rightfully claim a job creation tax credit, contact an experienced state tax credit advisor to analyze your situation.

How Do I Claim a Job Creation Tax Credit?

In general, job creation tax credits are claimed on your business’s state income tax return. Some states, such as Maryland, require you to apply before making credit-eligible hires.

Which States Offer a Job Creation Tax Credit?

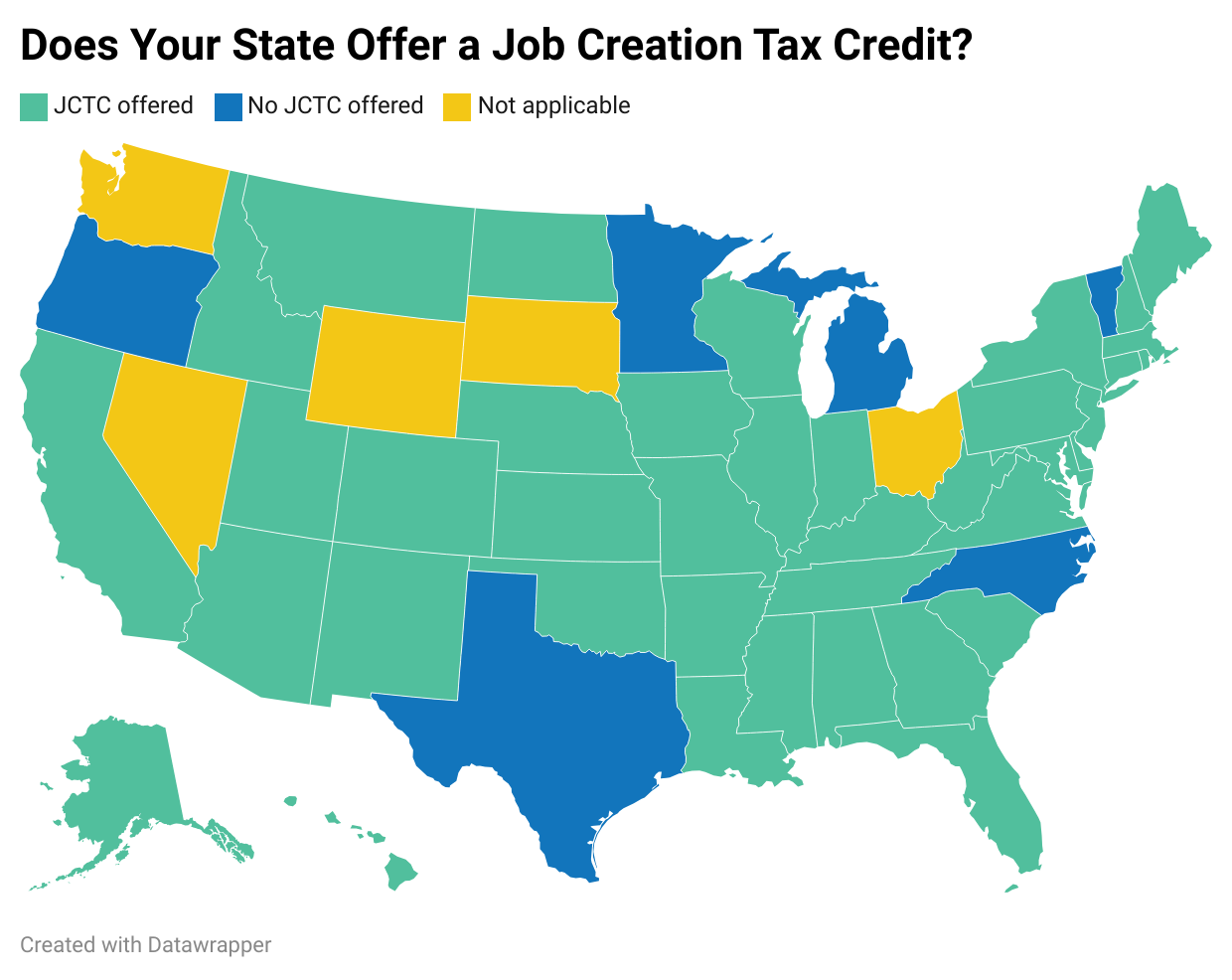

Most states offer at least one type of job creation tax credit, and many offer several that each target a different area of the state or group of workers. Here’s a visual of the states that provide job creation tax credits.

Note: States without a corporate income tax are marked “not applicable” but may offer other job creation incentives worth exploring. Contact a Smith + Howard advisor to understand the full extent of opportunities within a state.

A Review of State Job Creation Tax Credits

To understand the mechanics of a job creation tax credit, let’s review what’s on offer in California, Georgia, and Tennessee. Although each of these states also offers tax credits for hiring targeted groups, we’re focusing on their more general credits.

California Job Creation Tax Credits

Overview: The Golden State’s New Employment Credit provides a tax break for employers that hire eligible full-time employees who work in a designated geographic area (DGA), generally in the north and south of the state with high levels of unemployment and poverty.

Credit amount: 35% of qualified wages multiplied by the ratio of the net increase in full-time employees to the number of all California employees. Qualified wages are the first 60 months of wages paid to qualified employees who earn at least 150%, but no greater than 350% of your entity’s California minimum wage.

Credit length: 60 months starting on the date a new employee is first hired

Employer eligibility requirements:

- Be engaged in an eligible California trade or business operated in a DGA

- Hire qualified, full-time employees

- Pay qualified employees wages of at least 150% of the California minimum wage

- Have a net increase in jobs

- Obtain a tentative credit reservation for each qualified employee within 30 days of reporting their hire to the state

Employee eligibility requirements:

- Hired on or after their work location was made part of the DGA

- Perform at least 50% of their services in the DGA

- Work full-time

- Meet at least one qualification category at the time of hire:

- Unemployed for at least the previous six months

- Veteran who has been separated from the U.S. Armed Forces within the previous year

- Received the federal Earned Income Credit in the previous taxable year

- Ex-offender convicted of a felony

- Current recipient of state or county assistance

Georgia Job Creation State Tax Credits

Overview: provides an annual credit for each new job created during a five-year window. It’s only available to businesses that operate in specified industries, including manufacturing, warehousing, software development, or telecommunications. Once you start the five-year window, each new job created is eligible to receive a credit annually for five years, assuming the job is maintained; in other words, an eligible job created during the credit window can earn the credit for the next five years, even after the five-year credit window closes.

Credit amount: Between $1,250 and $4,000 (depending on location) annually for five years for each eligible new job created during the credit period

Credit length: Five years for each new job added during a specified five-year window, which means the credit can be claimed for up to nine years for a new job

Employer eligibility requirements:

- Operate a facility or headquarters in Georgia

- Be engaged in a specified industry

- Hire qualified, full-time employees

- Meet a minimum threshold for new jobs created, ranging from two to 25 (depending on the location of the project), to open a five-year credit window

- Offer health benefits consistent with other employees

- Pay qualified employees wages that exceed the average wage in the county with the lowest average wage in Georgia

Employee eligibility requirements:

- Hired during the five-year credit window

- Work full-time

Tennessee Job Creation Tax Credits

Overview: The Volunteer State’s Job Tax Credit pays a fixed amount per job added to eligible businesses that invest at least $500,000 in the state. Similar in function to Georgia’s Job Tax Credit, Tennessee’s Job Tax Credit window is usually three or five years. However, an additional credit with an extended period is available for investments of $10 million or more, with a maximum credit window of 20 years for investments of more than $1 billion.

Credit amount: $4,500 per qualified job

Credit length: Three or five years starting on the submitted business plan’s effective date (depending on the county in which the investment is made)

Employer eligibility requirements:

- Meet the definition of a qualified business enterprise, which includes projects that include manufacturing, warehousing, research, computer services, call centers, headquarters facilities, tourism, and more

- Make a minimum investment of at least $500,000 ($10 million for conventions or trade show businesses) within three years

- Create a minimum number of permanent, full-time jobs (seasonal or par-time allowed for some tourism jobs), ranging from 10 to 25 (depending on the business’s county)

- Submit a Job Credit Tax business plan to receive a tentative approval

- Meet minimum wage requirements (only in some cases)

Employee eligibility requirements:

- Hired during the three-year credit window

- Work full-time (unless disabled)

Before you count on qualifying for any of these job creation tax credits, remember that the eligibility requirements can be more complicated than they initially appear. Talk to an experienced tax advisor to confirm your eligibility.

Smith + Howard: Your Job Creation Tax Credit Experts

When deciding where to expand your business, it can pay to consider the effect of job creation tax credits available to your business. Advisors at Smith + Howard has extensive experience identifying and evaluating state tax credits and helping business leaders weigh the pros and cons of operating in specific states.

Learn about the job creation tax incentives available to your business by contacting us.

How can we help?

If you have any questions and would like to connect with a team member please call 404-874-6244 or contact an advisor below.

CONTACT AN ADVISOR