Back to Resources

Back to Resources

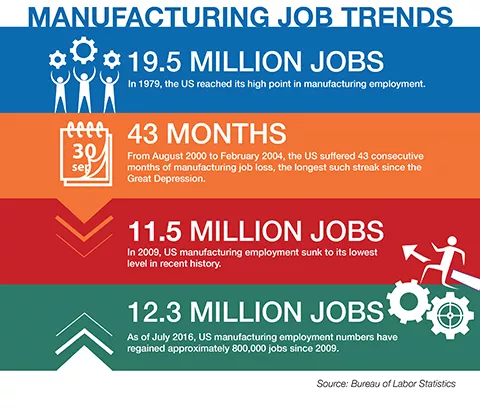

The upcoming presidential election has put some economic issues front and center, and one of them is the reshoring of jobs that were sent to other countries years ago to save companies manufacturing costs and – in some cases – taxes. In fact, over the past 30 years, the U.S. manufacturing industry has experienced the loss of three to four million jobs. While reshoring is gaining in momentum, it’s useful to look at the trends so see how many jobs are coming back to the U.S. and, in particular, to Georgia.

In our two-part series, “From Offshoring to Reshoring – Trends in U.S. Manufacturing,” Smith and Howard reviews the reasons for sending jobs offshore and what the future of manufacturing holds for Georgia and the nation. In Part I, we examine the highs and lows of manufacturing from 1979 through 2012. In Part II, we will look at the reshoring trend.

PART I

The Terms and the Trends

Outsourcing vs. Offshoring: What is the difference?

Many Americans refer to the terms outsourcing and offshoring when referencing the same thing – the exit of jobs from the U.S. to workers abroad. While the terms are often used interchangeably, there is a difference between outsourcing and offshoring.

Outsourcing refers to hiring an external company – whether in the U.S. or abroad – to perform a task that would normally be done internally. A company can outsource work to an independent contractor in Detroit or to a large manufacturer in Germany that makes a single part for a machine.

Offshoring refers to a company relocating a product or manufacturing operation to a foreign country without giving up control of ownership or the operation. In other words, if a U.S. car manufacturer opens a factory in China, it is offshoring because it maintains ownership of the company and operates the factory. Offshoring is not specific to the U.S.—it is a common practice of other countries, largely in Western Europe and Japan. The intent shared by any country that offshores is typically to benefit from lower wages and operating costs.

Reshoring: Returning Jobs to the U.S.

The return of manufacturing operations – and jobs – to the U.S. is referred to as reshoring. A number of factors and changing market conditions have led to this newest trend in manufacturing. Before discussing the changes driving manufacturing operations back to U.S. soil, it’s helpful to look at the conditions that have triggered the move from outsourcing to offshoring and back to reshoring.

The Outsourcing Timeline

Since the late 1970s, a number of factors came together that made outsourcing – and later, offshoring – a competitive strategy for U.S. companies: the trade deficit, increasing global competition and the elimination of trade barriers were major contributors.

At the same time, a poor economy in China created an opportunity to take advantage of skilled but low-cost labor and low-cost manufacturing. Many U.S. companies, eager to have parts made for less, outsourced to Asia, but then realized that relocating – or offshoring – their operations made more sense.

Over the next 15 years, some drawbacks began to surface, including compromised quality, inconsistent performance and an inability to adjust operations when sudden changes in product design occurred. For companies that maintained operations in two or more countries, it was also sometimes difficult to develop and nurture the kind of innovative thinking that is needed to stay competitive. Finally, when costs began to increase, especially in China, American businesses were soon talking about reshoring.

Tax Break: Corporate Tax Inversion

Before looking at the growing trend in reshoring, it is useful to consider another aspect of conducting operations offshore — lower taxation. U.S. tax inversion occurs when a multinational company, especially one with a substantial amount of income earned abroad, re-incorporates in a country overseas with a lower tax rate to reduce its tax burden.

For years, members of Congress have introduced legislation to require such companies to pay the higher tax rate. While the 2016 candidates of the two major U.S. political parties have language in their platforms to address offshore tax havens, it remains to be seen what, if any, legislative action will ensue in the coming years.

We continue our two-part series by examining the newest trend in manufacturing—the reshoring of jobs and companies back to the U.S. Specifically, we look at what is driving the trend, and its effect on Georgia and the nation.

How can we help?

If you have any questions and would like to connect with a team member please call 404-874-6244 or contact an advisor below.

CONTACT AN ADVISOR