Back to Resources

Back to Resources

The obligation to collect state and local taxes is onerous – more so in the food and beverage service, franchise, and distribution industries than anywhere. Sales and use tax regulations seem to change on an almost daily basis, forcing businesses to examine and adjust their compliance process on a state by state (and often locality by locality) basis – where each government sets its own tax rate. Add liquor sales to the mix and the complexity grows. When it’s all said and done, sales and use tax compliance can be an expensive and time-consuming function, fraught with the potential for costly errors and penalties.

So you might be asking yourself – what is my business obligated to collect and remit tax on? Taxable goods and services (typically defined at the state level through legislative efforts) are usually evaluated at two levels to determine taxability and the tax rate:

1. Classification of the goods (TPP or Tangible Personal Property) or services being sold. This is typically anything other than real property (land and building) that is used in the operation of a business or sold to a customer. Examples of tangible personal property include furniture, equipment/machinery, computers, cell phones, etc. Please keep in mind, several states are starting to tax services as well, so you need to keep this on your radar. Taxability of these items varies by jurisdiction, so it is imperative to discuss this with your tax advisor.

2. The jurisdiction where the sale was made is (typically, but not always) where your business is required to collect sales tax and determines what tax rate to use for the transaction.

Once your business has collected the tax, the process of accurately and timely filing, reporting, processing and paying those funds to the proper authority begins. This requires significant time as each business location can have different jurisdictional regulations. Compliance of this nature requires a well-thought-out strategy between the organization and the municipalities. There are many moving parts when it comes to compliance and developing an efficient and effective process will increase accuracy and ultimately save money.

What Smith and Howard Can Do for Your Business

An understanding of the specific areas in which businesses are required to collect and remit taxes is the important foundation of an effective compliance program. Smith and Howard’s Sales and Use Tax Group acts as an extension of the corporate tax department of large businesses, including those in the food and beverage industry. Our team has deep and extensive knowledge of the sales and use tax regulations across the country. Our clients include large food and beverage organizations that cumulatively have operations in all 50 states.

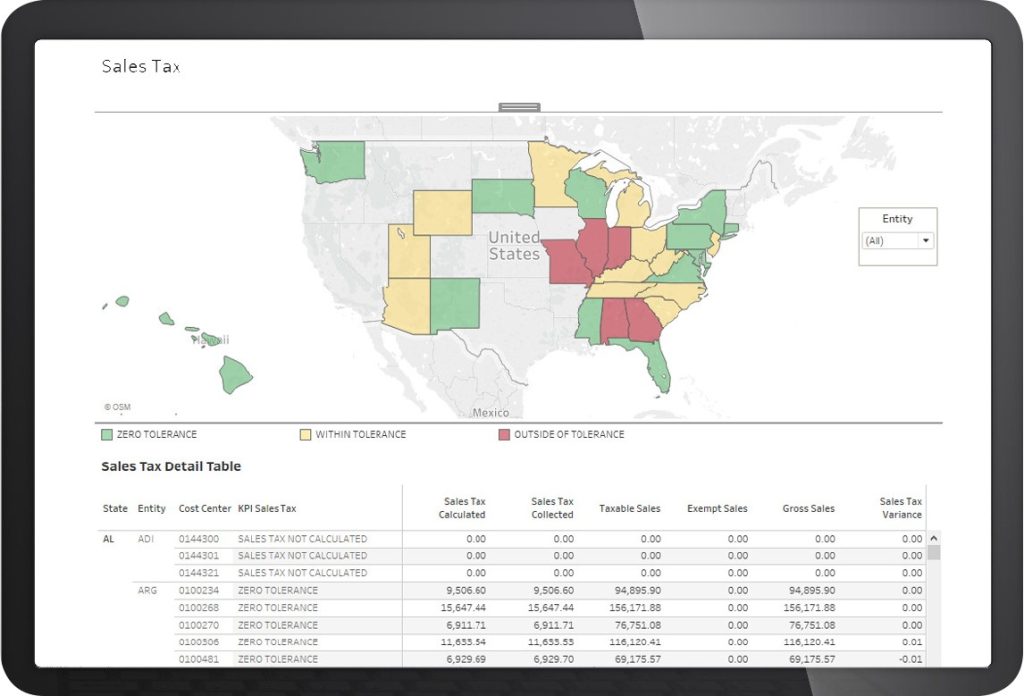

We offer a customized, proprietary tax automation platform that reports and tracks tax collections and compliance in real-time on a state-by-state basis. Our software (snapshot included) helps businesses save significant time and money on tax compliance, allowing them to leverage their staff in more productive ways while minimizing the chance of missed or incorrect sales and use tax reporting.

The ability to customize the platform to the operations and goals of each business means that you pay only for services needed. As an added benefit of increased efficiencies, your employees can shift their focus more to strategic, long-term goals as less time is spent on day-to-day tax compliance.

Your team can see data in an environment that lets you spot trends, identify underlying or potential issues and make corrections prior to incorrect or late reporting. Data is gathered and shared securely using ShareFile.

Our deliverables include tax returns, payments to state and local agencies and of course, the real-time dashboard that lets you track your activity and areas that fall outside your customized boundaries for allowable variances.

Businesses that benefit from our services include hotels for hospitality taxes, food and beverage businesses including restaurants – sit down, fast casual and QSRs – especially those that sell alcohol; food service distributors – those selling food and tangible personal property and many others.

For questions and to learn more, please contact Tim Howe by completing the contact form below.

How can we help?

If you have any questions and would like to connect with a team member please call 404-874-6244 or contact an advisor below.

CONTACT AN ADVISOR