Back to Resources

Back to Resources

Tax relief opportunities for owners of real estate can be found in unexpected places—from parking lot striping to lobby renovations and LEED improvements. In this article, we tackle some of the finer points of the repair and maintenance (R+M) regulations available to taxpayers. As you read, consider the types of R+M you may have performed or anticipate performing on your property, and see if we can help you take advantage of tax savings.

Election to Expense Capital Assets (De Minimis Safe Harbor)

A taxpayer may now elect to expense capital assets under a certain dollar amount threshold per-item, per-invoice. When the regulations were originally issued, that threshold was $500 for a taxpayer who did not have an audit of their financial statements and $5,000 if the taxpayer had audited financial statements. Under the new rules, non-audited taxpayers can elect to expense items under $2,500; the amount of $5,000 for audited taxpayers remains the same.

Every taxpayer who wants to reduce their tax bill should be taking advantage of this election whenever possible. Not only does this allow the taxpayer to expense items now, it also allows them to save their Section 179 deduction for assets that are in excess of the $2,500 (or $5,000 for audited taxpayers) threshold (in accounting terms, this is the “de minimis” threshold).

With this election, taxpayers are often able to expense a majority of their office and computer equipment, since the election is on a per-item, per-invoice basis. This is an annual election, and the taxpayer can change the amount they are electing to expense each year. There are a couple key factors that need to be considered before you decide to make this election:

1) The taxpayer must have this accounting procedure in place as of the beginning of the tax year.

2) The taxpayer is required to expense the amount paid on their audited financial statements, or books and records if not audited.

Unit of Property

How a taxpayer defines their unit of property is a great way to separate a 39-year depreciable building into units of property that qualify for shorter, faster depreciable lives. The IRS has some specific guidance on what a unit of property is, depending on the industry. For example, the IRS says that a unit of property under Section 1.263(a)-3(e) is comprised of two primary units of property – a building structure and building system – which can each be divided into smaller sections. For the building structure, the property can be divided into a roof, walls, floors, ceilings and foundation. For the building system, heating and ventilation, plumbing, electrical, elevators, escalators, fire protection and alarm systems, security systems and gas distributions systems can be broken out as separate systems. It is important to understand how the expenditure relates to the unit of property as a whole in order to determine whether the expenditure needs to be capitalized or expensed.

Understanding units of property provides the foundation for applying Improvement Standards and Dispositions, as described below.

Improvement Standards: Capitalize or Expense?

The improvement standards define when expenditures are required to be capitalized under the new regulations. If the acquisition of property relates to a betterment, adaptation or restoration of the original unit of property then it must be capitalized. Otherwise, the expenditure can be expensed.

Betterment: A betterment occurs when the expenditure corrects a pre-existing defect, or if it reasonably expects to materially increase the productivity, efficiency, strength, quality or output. For example, a taxpayer purchases a building with an unstable foundation that requires significant expenditures to bring it up to code. This would be a pre-existing material condition and the expenditure would need to be capitalized. Another example of a betterment is if the entire heating and ventilation system was replaced to a new green LEED certified version. Since this is materially increasing the efficiency of the system, this would need to be capitalized.

Adaptation: An adaptation is when a unit of property is altered to have a new or different use inconsistent with the intended use when originally placed in service. This is something we do not see often in the real estate industry and new cost must be capitalized.

Restoration: A restoration happens when the unit of property is completely replaced as if it were completely brand new. Since the asset is being treated as completely replaced and brand new, the taxpayer is allowed to dispose of the old asset on the books.

The Process

For our clients who have made significant acquisitions to their buildings, we would typically review the invoices to determine if the expenditures fall into one of the three categories listed above. In many cases, we find that several expenditures can be written off as repairs, which can turn a 39-year slow depreciation deduction into an immediate expense. For example, we have a client who had $1.6 million in roof and parking lot expenditures. By analyzing the invoices for the work that was performed, we determined that they could expense $1.1 million because the work was related to restriping the parking lots and/or replacing roof shingles. While this service falls outside the standard tax engagement, it has the potential for significant tax savings for many clients.

Partial Dispositions and Unit of Property

Before the guidance provided by the new regulations, many taxpayers simply capitalized one asset on their books labeled “building.” Now that the IRS allows taxpayers to break the building into separate units of property, part of the old building associated with the purchase of the new unit of property can be written off.

In order to appropriately partially dispose of an asset, the taxpayer will need to define the unit of property as discussed above. Second, a discount to the price purchased for the new unit of property using the Consumer Price Index (CPI) to the date of the original asset will be applied. The resulting calculation is what is allowed to be disposed of in the current year.

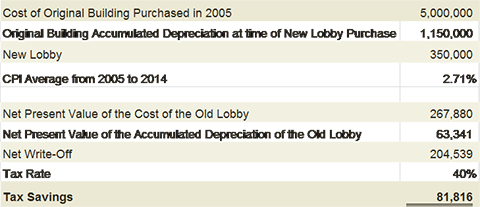

For example, a taxpayer completely replaces the entire lobby in 2014 for $350,000. The building was originally purchased in 2005 for $5,000,000. The accumulated depreciation when the new lobby is purchased is $1,150,000. If we discount the price paid for the lobby in 2014 dollars back to 2005 we would get a cost value of $267,880 and an accumulated depreciation value of $63,341 using the average of the CPI index. The regulations will allow the taxpayer to dispose of $267,880 cost and $63,341 of accumulated depreciation on the original $5,000,000 building, and they will have to capitalize the new lobby for $350,000.

In the table below you can see the cost saving this generates at a 40% tax rate:

This is a great tax strategy because it took a 39-year asset that was depreciated only one-quarter thus far and expensed it in the current year.

Additionally, we want to point out that in 2014, taxpayers had the opportunity to execute a late partial disposition without filing a Form 3115 (Change of Accounting Method) with the IRS. A late partial disposition is when the taxpayer executes a partial disposition transaction, but the acquisition does not relate to the current tax year. Taxpayers can still do a late partial disposition, but it now requires filing a 3115.

If you have any questions on R+M expenses or other real estate tax matters, please contact a member of our tax team at 404-874-6244 or use the contact form below.

How can we help?

If you have any questions and would like to connect with a team member please call 404-874-6244 or contact an advisor below.

CONTACT AN ADVISOR