Back to Resources

Back to Resources

Companies with profitable export sales may realize permanent tax savings by utilizing an Interest-Charge Domestic International Sales Corporation (IC-DISC).

For more than 40 years the IC-DISC incentive has provided tax savings to U.S. exporters. If you qualify, Smith and Howard might be able to help you realize a tax savings of up to 19.6 percent by setting up an IC-DISC.

All entity types can utilize a DISC, including:

- C corporations

- S corporations

- LLCs

- Partnerships

What is an IC-DISC?

- A domestic corporation that has elected to be an IC-DISC.

- At least 95 percent of its annual gross recipients are qualified export recipients.

- At year-end, the adjusted basis of its qualified export assets is at least 95 percent of the adjusted basis of all of its assets.

- It has only one class of stock with a minimum par/stated value of $2,500.

- The entity maintains separate books and records for the tax year.

- Its tax year conforms with that of its principle shareholder(s).

If you have export sales, Smith and Howard can consult with you to identify potential tax benefits of setting up an IC-DISC. Call us at 404-874-6244 or complete the contact form below.

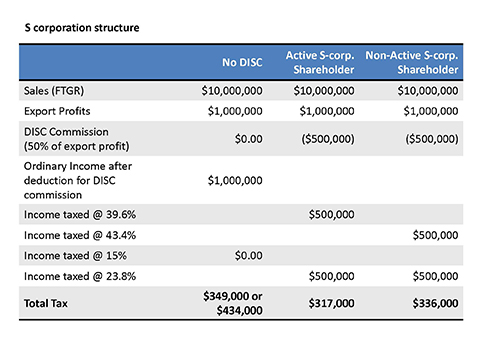

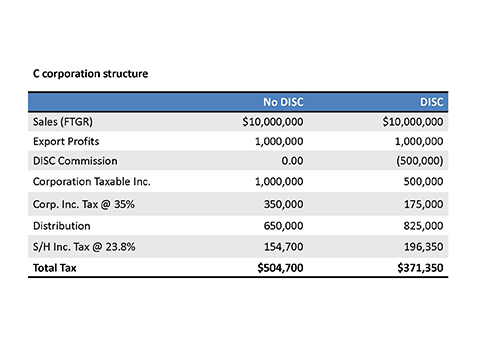

Example of IC-DISC Tax Benefits

This article originally appeared in BDO USA LLP’s “International Tax Practice” brochure. Copyright (c) 2015 BDO USA, LLP. All rights reserved.

How can we help?

If you have any questions and would like to connect with a team member please call 404-874-6244 or contact an advisor below.

CONTACT AN ADVISOR